Forrester Decisions research services help clients shorten the distance between bold vision and superior impact — providing the insights, resources, and hands-on guidance to develop key capabilities in-house, lead organizational change, and deliver results. Explore the value and ROI organizations may realize by investing in Forrester Decisions.

![]()

The client organization experiences $2.54 million in benefits over three years, a net present value (NPV)** of $1.83 million, and an ROI of 259%

“Forrester Decisions has backed up a lot of the assumptions that we had been operating under with credible, researched-based proof. This has helped secure more funding for larger initiatives and drive cross-functional alignment.”

— B2B manager of a technology company

![]()

Access to relevant frameworks and research and deep engagement with analysts through Forrester Decisions improved the success rate of transformational initiatives by 26%.

![]()

Leveraging Forrester Decisions enables transformational initiatives to be completed up to 50% faster, or 13 weeks sooner, for the composite organization than otherwise possible.

“Forrester Decisions played a significant role in helping us to double our revenue goal with our transformation. Without them, we would have started much, much smaller, and the scale of the entire initiative would not be as big as it was.”

— Senior director of revenue marketing, industrial office equipment

![]()

The composite organization grows revenue for its new product by an extra 4% annually because of analyst guidance, data, and research provided through the Forrester Decisions platform.

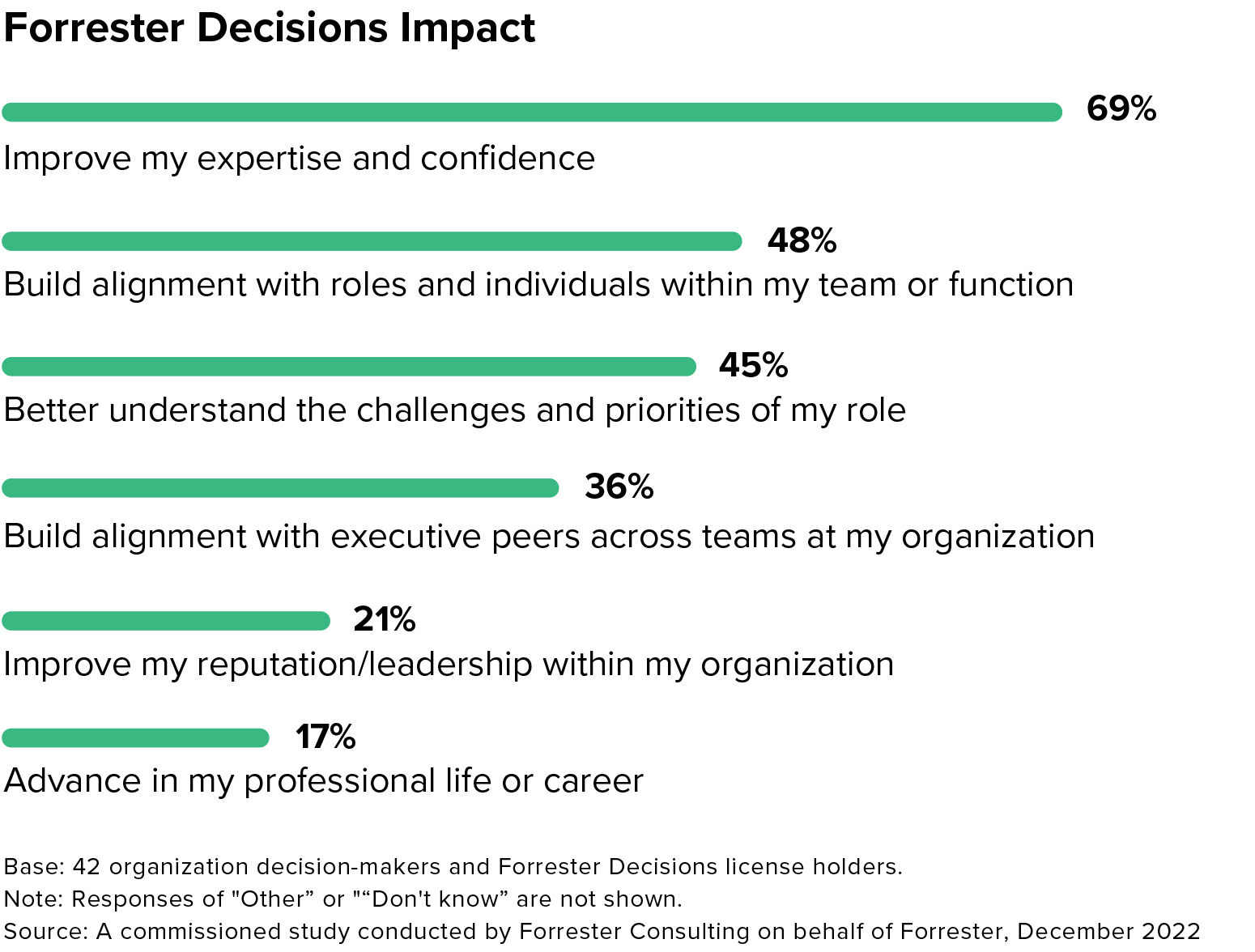

What Are The Benefits Of Forrester Decisions?

Forrester Decisions clients see value both at the organizational level and at the personal level.

“I am constantly being inspired by the research Forrester produces — in my case, research to improve our ability to design and inspire customer experience.”

— head of customer and marketing insight at a financial services company

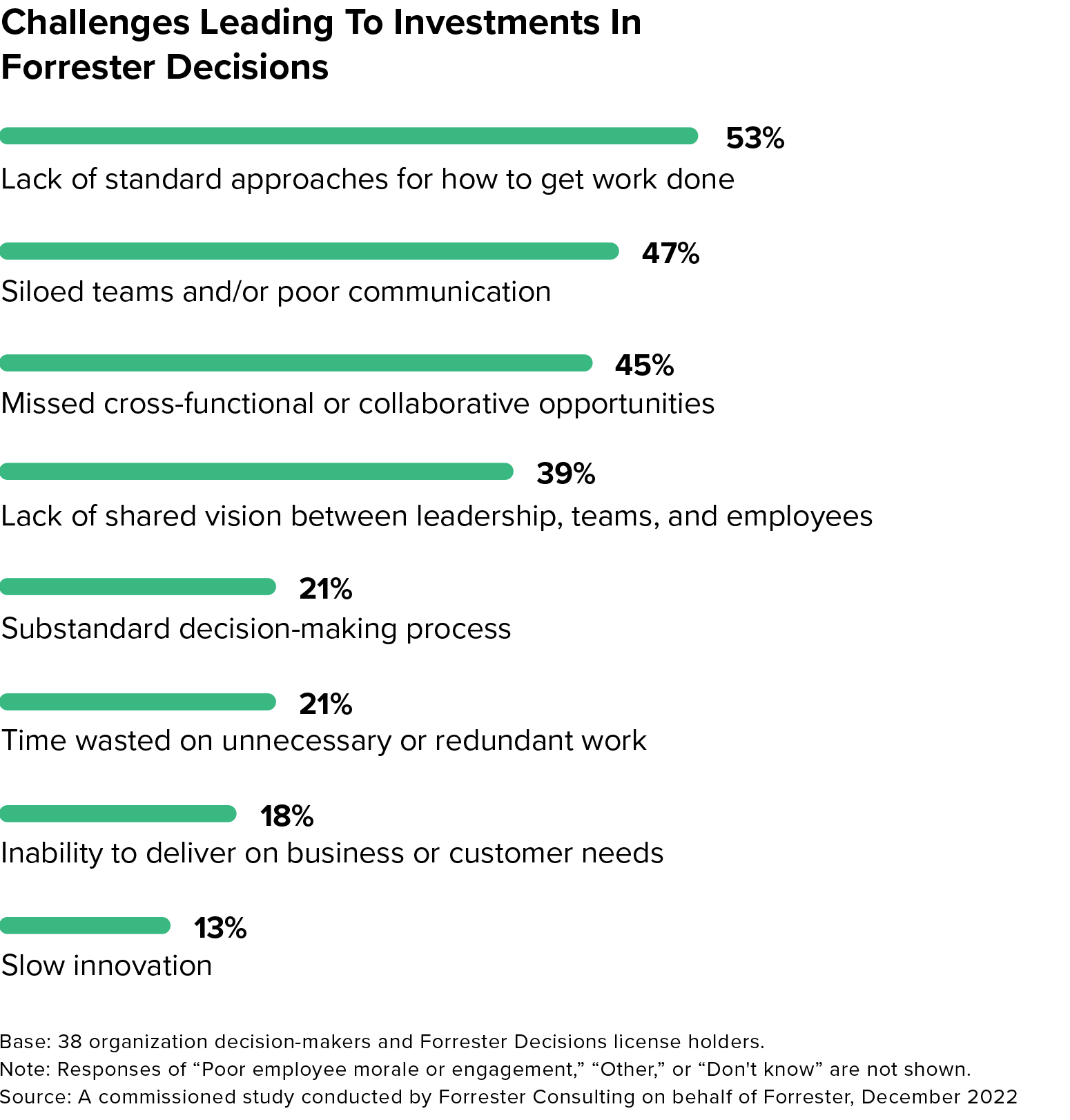

What Brings Companies To Forrester Decisions?

Missed opportunities due to lack of alignment were among the biggest pain points current Forrester Decisions clients cited in making the decision to invest in a service.

“In the face of budget cuts, I chose Forrester because I found them more unbiased, more engaging, and able to provide insights I can act on. … I doubled down on Forrester for better ROI.”

— Vice president of enterprise and business architecture, financial services

Get The Full Analysis

If you want to read the full 30-page Total Economic Impact (TEI) report on Forrester Decisions, download it here.

Thank you!

Ready to learn more now? Give us a call:

Americas: +1 615.395.3401

EMEA: +44 (0) 2073 237741

Asia Pacific: +65 6426 7060

“A challenge we had in alignment for many, many decades, even before I joined the company, was solved through the Forrester Decisions program. They walked us through the framework process and adjusted it to meet our business needs. Forrester was also able to connect us with peers in the industry. This was a major contribution to our initiatives because we were able to speak with others facing similar challenges, and some who had already gone through multiple iterations.”

— Chief enterprise architect, global recruitment, staffing, and professional services firm

*Forrester conducted a Total Economic Impact™ (TEI) study to examine the value and return on investment (ROI) organizations may realize by investing in Forrester Decisions. Forrester Consulting surveyed 42 users of Forrester Decisions and interviewed four others to create a representative composite organization based on characteristics of the interviewed organizations.

** Net present value is the present or current value of (discounted) future net cash flows given an interest rate (the discount rate). A positive project NPV normally indicates that the investment should be made unless other projects have higher NPVs.