Introduce The Marketing RaDaR To China

Marketers in China are becoming more aware of the effectiveness of their marketing spending. They will no longer blindly spend a lump sum on China Central Television’s ad auction, for example. Home appliance giant Haier Group recently announced that it will stop spending on traditional magazine ads and maintain paid editorials only.

As Chinese consumers increase the time they spend on new channels such as social and mobile, it's more important than ever for marketers in China to optimize all touchpoints to reach and make an impact on their target audiences, especially when it comes to the new challenge of multichannel and multiscreen orchestration.

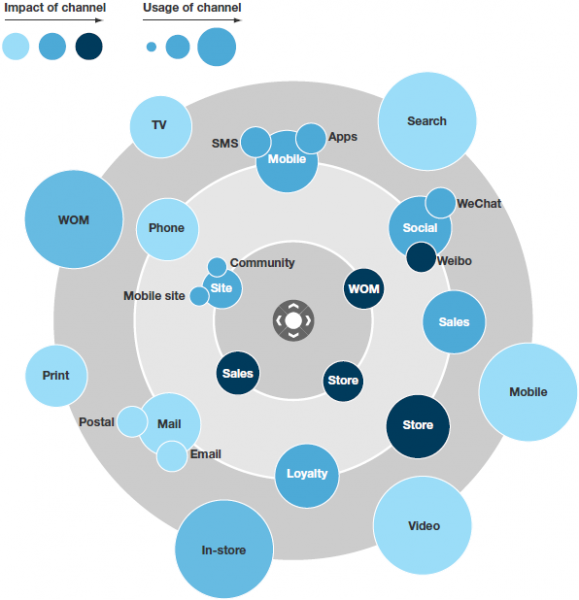

My recent report Sharpen Your Mix In China With The Marketing RaDaR illustrates how the RaDaR framework (first introduced by my colleague Nate Elliott) can help marketers successfully prioritize resources across their entire marketing mix in China.

RaDaR refers to “reach and depth and relationship” — three types of channels. Smart marketers are beginning to embrace a four-stage customer life cycle, from discover, to explore, to buy, to engage, then back to discover, and different types of channels support different stages of the life cycle:

- Reach channels support discovery. Chinese consumers use channels such as in-store promotions and online search to discover brands.

- Depth channels support exploration and purchase. Chinese consumers use channels such as consumer review sites and friends’ recommendations to research products and services they want to buy.

- Relationship channels support engagement. Chinese consumers use channels such as brands’ websites or talking to salespeople to engage with the companies from which they've bought.

Forget about “paid, owned, and earned,” and embrace the marketing RaDaR. Most marketers in China are familiar with the paid, earned, and owned model and apply it to media planning. This model is from the marketers’ perspective and describes only the characteristics of media channels. In contrast, the RaDaR model puts customers in the center of media planning and describes customers’ relationships with those channels.

Due to China's unique media landscape and consumer behavior, the RaDaR for this market is also unique. If you're interested in increasing the efficiency of your media planning in China and want to learn more about the reach, depth, and relationship channels that would work for your target audience in China, please read the full report.