What Comes After The Unicorn Carnage?

According to CB Insights (thanks, guys!), by the end of 2015, investors had given 152 tech startups “unicorn” valuations of more than $1 billion. But now, valuations are deflating for many private and public tech companies. Is this 2000 all over again? No. The bubble popping over the next two years will mean job loss in Silicon Valley and a pullback in disruptor investment but not a collapse of tech spending or of the wider economy. CIOs and CMOs should seize this small window of opportunity to hire or acquire talent for digital transformation to serve customers in the digital channels of their choice.

That’s our conclusion (24 analysts contributed to this analysis, with special thanks to Chris Mines and James McQuivey) in new Forrester reports for CIOs and for CMOs. We present the full analysis there, but here’s a (long) summary.

1. The Unfolding Carnage Of Unicorns — There’s Blood In The Water

Private investors dramatically drove up the number of unicorns — private tech companies they valued at more than $1 billion — from 31 in 2012 to 152 in 2016. But down rounds and post-IPO stock collapses have begun. Accel Partners’ Jim Breyer, believes 90% of unicorns will be repriced by investors or die. He called it “blood in the water.”

- Alas, most unicorn revenues can’t justify their valuations. For many customer companies, the revenue multiples are bigger than Facebook’s quite amazing 10x price/revenue ratio. But Facebook has an awe-inspiring ad engine. It made $1.34 per monthly active user in Q4 2015. Snapchat, which we think investors are granting the same multiple, projects it will make $0.17 per monthly active user in 2016 ($300M/150M users/12 months). Can Snapchat get to $1.34 to justify its valuation? Hard to imagine how.

- And subscriber economics are less attractive than investors thought. Startups got funding based on a pitch of low customer acquisition costs and high customer lifetime value. Those metrics aren’t holding up, even for mature software-as-a-service players like Salesforce or Workday. Belatedly, investors are looking hard at “unit economics” — the actual costs and revenues of each new customer. Summarized across all customers and accounting for churn, suddenly the economics of subscriber growth don’t look that attractive.

- Finally, early adopter enthusiasm doesn’t guarantee mainstream adoption. GoPro missed revenue and earnings projections because it turns out that not everybody wanted a GoPro in their stocking. Market saturation forces Dropbox to spend more to win each new paying customer. Any consumer market veteran can share desperate tales of next-big-thing products winding up in the discount bin.

2. The Unicorn Carnage Won’t Lead To A Tech Industry Meltdown

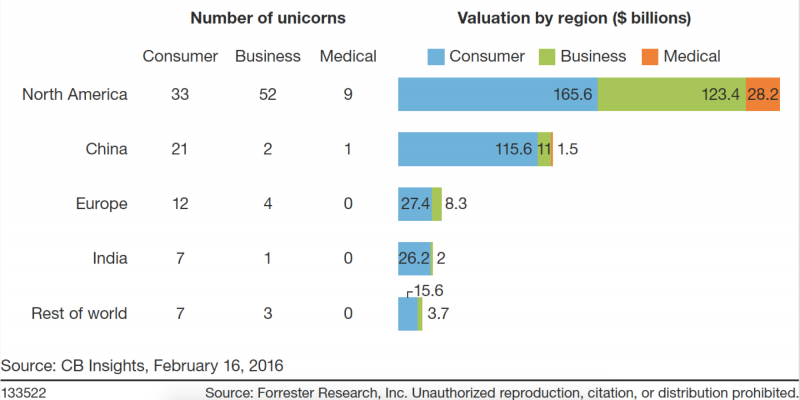

Are we going to see a tech industry meltdown as we did in 2000 and 2001? Nope. We examined all 152 private unicorns and categorized them into 24 sectors, then grouped those into customer, business, and medical, and worse in China, Europe, and India than in North America. See the chart we built using unicorn data from CB Insights. (I see that we’re up to 155 unicorns today.) Unlike in 2000, firms will keep investing in business technology, which will bolster those business models (if not their valuations). So the carnage will be biggest in consumer sectors like car services, consumer hardware, and shopping.

Figure 1 Consumer Unicorns Have The Biggest Valuation And Broadest Distribution Around The World

Does that mean incumbent companies can relax? Nope. The unicorn carnage does not mean that digital transformation is slowing. Customers are digital. It’s how we live. Companies either digitally transform to serve customers where they live — or watch as customers find companies that can. CIOs and CMOs must keep the pedal down on digital transformation. The devaluation of digital disruptors means only that they have handed you a small window of opportunity to become digital.

- Snatch up digital talent. Tired of competing with the allure of Silicon Valley? For the next two to three years, that pressure will ease and give you the chance to attract marketing technologists, data scientists, and digital designers. Millennials looking to apply their digital skills to innovative projects will find Minneapolis as rewarding as Manhattan and Salt Lake City as career-boosting as San Francisco — as long as you truly deliver on this message: We’re doing everything they were going to do over there, just at a better cost of living.

- Acquire disruptors that augment or cannibalize your business. Join the rising tide of firms acquiring technology companies and establishing incubators. The likes of BofA, General Electric, JetBlue, and Walmart should continue their incubator investments with a focus on industry alignment and geography. Cost will be low. Opportunities will only increase. Be your own startup wave, and throw shoestring dollars at 15 to 20 startups.

- Hedge business technology bets with multiple pilots. Some of the digital opportunities — cybersecurity and predictive analytics, for example — are too important not to keep after. But to avoid relying upon failing startups, CIOs should find multiple solutions to the same problem and let the pilots unfold while the vendors prove their mettle. For example, if you are testing out new customer analytics solutions, run pilots with Evergage and Qubit to see which fits best and which you are most confident in.

4. But Unicorn Carnage Will Reshape The Next Wave Of Disruption

Tomorrow’s disruptors will come roaring back to a landscape shaped and hardened by the carnage. They will be wiser and more numerous. The opportunities they will chase will be more pervasive and more focused on your industry and market niche.

- Investors will diversify into industry and market niches. As the big-bang disruptions in financial services, media, car services, and shopping play out, entrepreneurs and investors will find and target smaller, more industry-focused opportunities. Look for investments in infrastructure monitoring and repair, water supply protection, refrigerated container optimization, and citizen service technology.

- Future disruptors will better understand customer acquisition costs. Rapid7 is spending 63% of revenue on sales and general expense. That’s not a recipe for success. Investors have been very patient as subscription businesses like Amazon and Salesforce have grown revenues without generating significant earnings. Amazon’s price-to-earnings (P/E) ratio is 460, and Salesforce’s is infinite (because it has no “E”). Unicorns building subscription businesses won’t get away with that for long. Apple, by comparison, has a P/E of 11, and Microsoft’s P/E is 37. The next wave of disruptors will think more carefully about their total addressable markets — and the cost of acquiring customers.

- Heartland cities will compete to become the disruptive center for their industries. City planners and politicians will focus their programs on disruptors in their core industries. Kansas City and St. Louis will promote investments in connected agriculture. Detroit will focus on connected cars, and Pittsburgh will focus on education and healthcare. And planners in Munich and Perth, Australia will focus on their markets in manufacturing and mining.

- The next wave of startups will use lean operations to deliver even more lethal blows. The economics of the cloud continue to drive down the cost of innovation and operations, leading the next wave of unicorns to innovate even faster at even lower cost. Snapchat, for example, already uses Amazon Web Services to efficiently store and process photos and messages. It could save even more by using artificial intelligence to mine essential metadata and skip storing the photo altogether while retaining the core of the value. Lower cost of innovation means even more digital disruption experiments.