After The Unicorn Carnage, Does Digital Disruption Take A Holiday?

We are seeing significant devaluation for startups and maturing unicorns (startups that soared above $1B in valuation). Valuation deflation was not just inevitable; the correction was overdue.

Evidently, not everybody needs a shiny new GoPro. Not every brand is ready to advertise on Snapchat. Not every regulator is ready to give Uber or Zenify a free ride. Not every company is ready to move its file system to Box.

Consumers and businesses do not have insatiable appetites for everything. That slice of reality was left out of entrepreneurs’ pitch decks and investors’ funding decisions. In a classic herd mentality driven by the fear of missing out, venture capitalists, private equity investors, even mature money managers funded 152 digital startups at valuations more than $1 billion (according to CB Insights as of February 16, 2016). That’s up from 39 unicorns in November 2013. Do the math: There are almost four times as many billion-dollar startups today than two years ago.

The desire to replicate the results of the best companies drove these giddy investments. But when investors start valuing startups based on the best imaginable metrics — Facebook-quality price-earnings ratios, smartphone-level adoption of every new gadget, or Salesforce or Amazon levels of SaaS valuations — the valuations en masse soar beyond credibility.

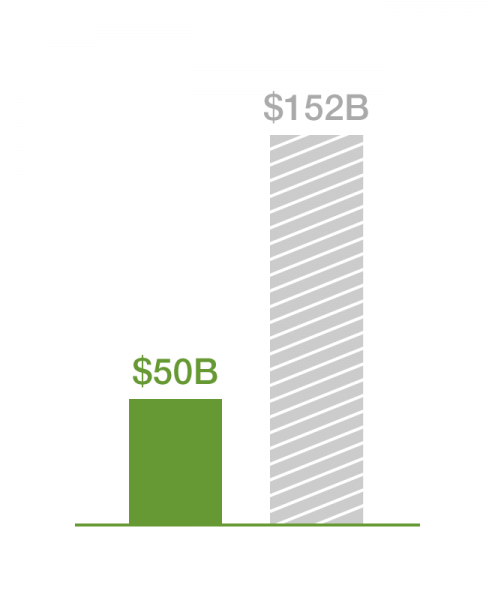

To justify their collective $532 billion valuation, unicorns would (coincidentally) have to generate $152 billion in revenue today. (That's based on the historical price-revenue ratio in the tech industry of 3.5x). But our quick estimate is that the 152 companies generated only $40 or $50 billion combined in 2015. And collectively they are losing money.

Venture capitalists are now taking a cold, hard look at reality. One prominent venture capitalist, Accel Partners’ Jim Breyer thinks 90% of unicorns will be repriced or die. He called it “blood in the water.”

But does that mean we're facing a collapse of the technology economy? Will digital disrupters disappear? Is this the dot com bubble 2.0? Was it all a fad? Can you go back to business as usual?

No way.

Digital disruption is not simply innovative companies creating new value. Today’s disruption is a joint venture between innovators and empowered customers. We believe devaluation simply lessens the disruption force.

The strongest digital disrupters will continue to storm your gates, steal your customers, commoditize your value, undermine your channel economics, and empower your customers to arbitrage your services. And they are in action mode:

- Well-operated digital companies will not just weather the storm but will get more aggressive.

- Low-priced acquisitions (and acquihires) will put a booster shot into digital sharks that see blood in the water as pure opportunity.

- And even with less investment capital, the cost to innovate and disrupt is and will be extremely low, thus keeping the flow of disrupters moving.

This sense of action mode should be your playbook as well. You can stop playing defense and competing on your heels, and take this moment as a great opportunity to accelerate your pace of digital innovation:

- Power up M&A planning to see how you can buy digital talent or capabilities on the cheap.

- Co-opt the disruptors but from your position of power. Harness digital and transform your customer engagement, business model, and products and services.

- Take advantage of a calm in the storm, and shift to a digital business model that dramatically improves your competitive capabilities. You then will be prepared for when this disrupter lull is replaced by a new wave of digital mania.

It may appear counterintuitive to go faster when the pace of disruption is slowing down, but taking a macro view provides great clarity:

- Digital disruption is a permanent force in our economy and will be for a generation.

- Empowered customers will enthusiastically seek out companies that deliver the best digital experience and provide them greater power and control.

Stay tuned for in-depth research on this topic, including the impact of unicorn carnage on industries facing disruption such as financial services, travel, distribution, manufacturing, media, and high tech.

Thanks to Victor Milligan and Chris Mines for work on this post.