The Canada Customer Experience Index For 2016, Part 1: A Year Of Stagnation

I’m happy to announce that we just released this year’s Customer Experience Index report for Canadian brands. The report is based on Forrester's CX Index™ methodology, which measures how well a brand's customer experience strengthens the loyalty of its customers. We use this methodology to create an annual benchmark of CX quality at 193 Canadian brands.

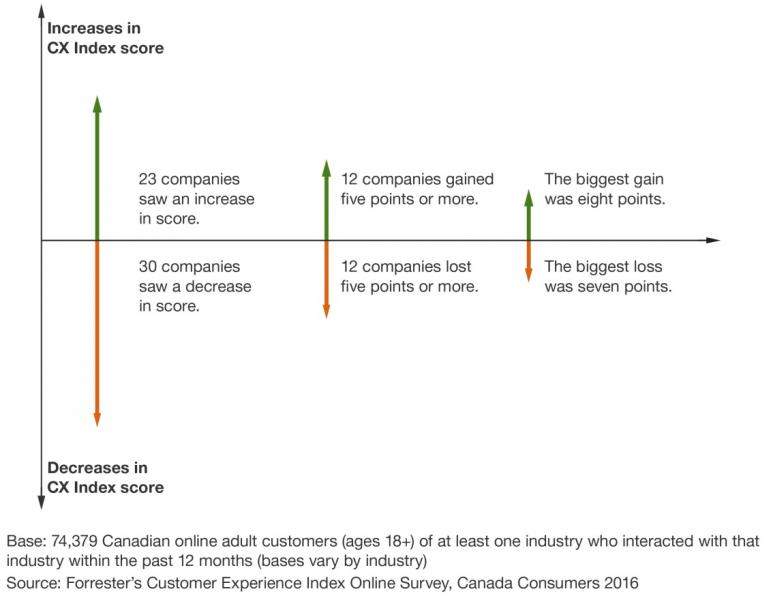

We found that between 2015 and 2016, the Canadian customer experience stagnated.

- Score changes at the brand level were remarkably minimal. Only about one-quarter of brand scores changed at all, and those changes were small across the board. A similar number of brands rose as fell.

- Fourteen industry averages showed slight movement. Four industry averages rose and 10 fell. However, these movements were usually very small and rarely changed the rank order of industries significantly. Only two industries’ performance changed substantially: The wireless service provider industry rose, and the PC manufacturer industry fell.

- Leaders and laggards by industry were mostly unchanged. Within the 18 industries we studied, 12 industry leaders and six industry laggards held their positions. However, some top and bottom spots changed hands only because we added new brands this year that scored higher or lower than last year’ languishing leaders and laggards.

CX At Traditional Firms Now Meets Or Beats The Digital Competition

We also compared CX in traditional and digital industries and found that traditional industries now perform as well as or better than their digital competition.

- Traditional banking pulled further ahead of direct banking. The traditional banking industry now has a higher average score and a higher low score than its digital-only competition in the direct banking industry.

- Direct investing failed to catch full-service investing. The full-service investment industry maintained a higher average score, higher high score, and higher low score than the direct investment industry. However, both industry averages fell this year.

- Bricks-and-clicks retail pulled nearly even with digital retail. The two industries now have similar average and high scores as well as identical low scores. Comparing their averages, the traditional retail industry rose this year while the digital retail industry fell slightly.

- Over-the-top (OTT) services debuted at parity with traditional TV service providers. This year, for the first time, the CX Index included OTT service providers — companies that distribute video over the internet through a subscription model (like Netflix) instead of through a legacy pay-TV provider (like a cable operator). In their debut, OTT service providers averaged the same score as traditional TV service providers, although traditional TV providers had a higher high score and lower low score.

Next week, Forrester Vice President of CX Index Roxana Strohmenger will explore what we discovered about the key role that emotion plays in CX in Canada.