The Data Digest: Mobile Banking Uptake

The New York Times recently published an article based on a Forrester report (Mobile Is The New Face Of Engagement) about the uptake of smartphones worldwide in the years to come. And for 2011 it was estimated that just under 500 million smartphones were shipped. Knowing the drivers behind the growth of smartphones gives businesses confidence in mobile technology investment — even when uptake is currently still limited.

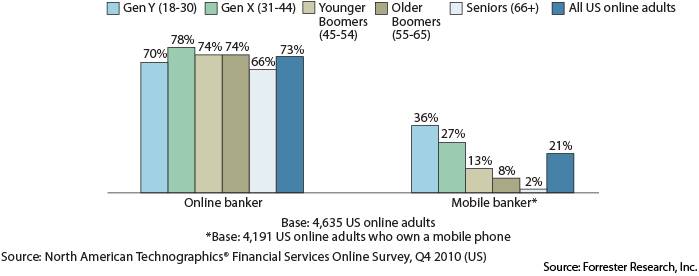

In the US today, Consumer Technographics® data shows that mobile usage is still far from mature in many industries. Take the financial industry as an example: 21% of US online adults with a mobile phone do any form of mobile banking versus 73% of US online adults who do online banking. When looking at the different generations, we see that younger generations, who are more likely to be early smartphone adopters, dominate in mobile banking.

Apart from smartphone ownership, there are other factors that lead to low uptake of mobile banking, such as security concerns, switching costs, and mobile technology sophistication.1 However, mobile will become the new engagement touchpoint between businesses and customers. And businesses understand that. Forrester's Q4 2011 Global Mobile Maturity Online Survey found that increasing customer engagement and satisfaction top the list, with 53% and 39%, respectively, of executives making these their primary goals when developing mobile services.

______

1 See The Changing Landscape Of US Consumers' Digital Banking for details of what’s preventing US online adults from using mobile banking.