The Data Digest: Interest In Mobile Payments

PayPal recently shared its new peer-to-peer payment functionality that allows Android users to pay each other by tapping two Near Field Communication (NFC) enabled devices together. A user enters the transaction information and then taps her phone up against another phone also equipped with the same PayPal widget. After the phones buzz together, the recipient can decide to send or receive money by entering a PIN number.

Sounds very interesting, but are consumers interested in this functionality?

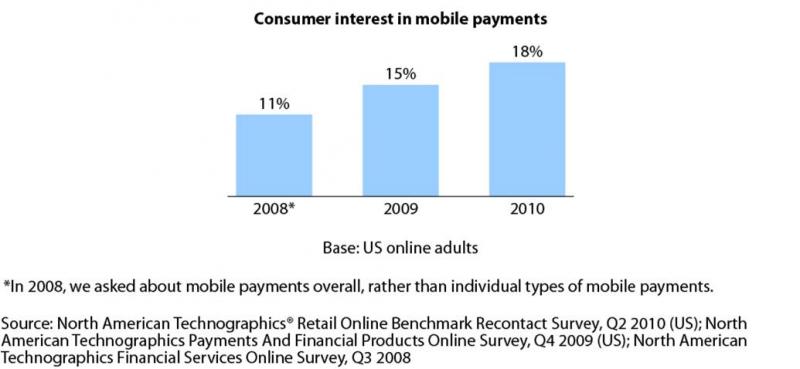

My colleague Charlie Golvin recently blogged about the Google Wallet initiative and its hurdles, one of them being lack of consumer interest. In fact, our Technographics® surveys show that interest in mobile payments is low and has not translated into activity in the US: Less than 6% of US online adults have ever used any type of mobile payment. Over the past three years, Forrester has seen interest in mobile payments continue to grow slowly.

Our data shows that person-to-person (P2P) mobile payments — sending money to other people via a mobile device — gains interest from only one in 10 US online adults. But consumers who are already using this technology are regular users. Also, US consumers who express interest in mobile payments spend 22% more, on average, than people who are not interested in mobile payments, and they are more likely to make frequent purchases. This makes them a desirable target group for banks, payment networks, and retailers.