Which Nifty Mobile Banking Features Is Your App Missing?

Not long ago, Forrester published a report that listed “Eleven Mobile Features That More Banks Should Offer.” These features are nifty and valuable mobile services that a majority of banks worldwide don’t offer. As a follow-up to this research, we thought that we’d share three additional mobile banking features that we see more companies rolling outin the near future:

- Cardless ATM transactions. Over the next five years, Forrester predicts a sharp rise in cross-channel banking interactions – in which a customer or prospect moves from one touchpoint to another to complete an objective. Mobile will act as the so-called “connective tissue” in many of these cross-channel journeys. For example, some banks* now support mobile-to-ATM cardless cash withdrawals. In general, the bank’s mobile app generates a code that customers can either use to enable ATM usage or send to others who can then withdraw cash directly from an ATM. Leading banks are enabling cardless ATM transactions in an effort to expand their mobile services. Wells Fargo, for example, already has a good mobile app — and the company is now being proactive by rolling out cardless ATM access and other next-generation features. There are many scenarios and mobile moments where cardless ATM transactions will prove their worth in convenience and value to customers.

- Nontraditional product offers. In the age of the customer, digital transformation means business transformation. Mobile banking is not only an extension of traditional financial services but also increasingly a space where digital teams explore different ways of engaging customers, new revenue streams, and other adjacent innovations. Executives and their teams at leading banks are experimenting with offers and services on mobile apps that go beyond traditional products. For example, CIBC now markets and sells precious metals and foreign currencies within mobile banking. USAA, meanwhile, promotes discounted tax software for mobile banking customers during tax filing season.

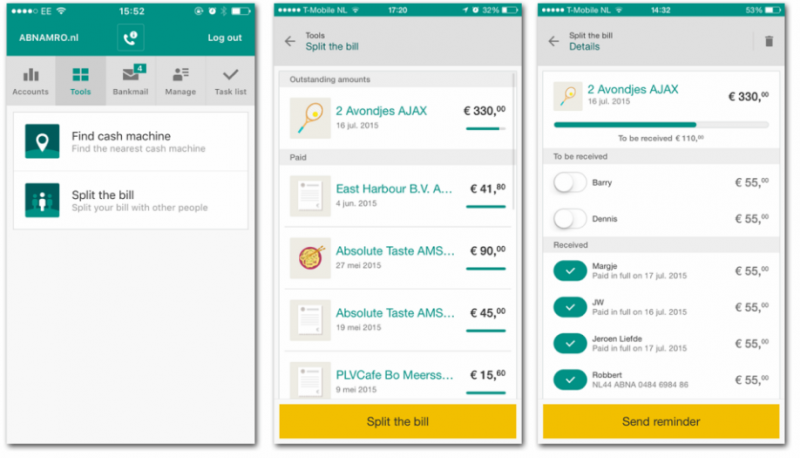

- Shared finances features. Forrester defines shared finances as situations in which one person acts as an observer of, partner in, or proxy for another person’s finances. Our research shows that people’s interpersonal financial relationships involve complexities and needs that banks’ current services fail to fully meet – and we predict increased demand for products and services that help customers manage shared finances. Too few banks offer such services via their mobile apps and sites, though a few leading firms offer a glimpse of innovative features: For example, the Dutch bank ABN Amro lets groups of friends use mobile banking to conveniently split a bill among multiple people, and even send reminders for outstanding P2P payments (see image below).

I encourage you to read the full report, and let us know which mobile banking features you think are especially interesting in the comments section below!

*Around the world, a small group of leading banks offer cardless ATM transactions via mobile. This list includes Australia’s CommBank and Westpac, India’s ICICI Bank, Poland’s PKO Bank Polski, Spain’s Bankinter and CaixaBank, Turkey’s Akbank, and the UK’s NatWest.