In 2016, Financial Services Executives Will Bet Big On APIs

We’ve just published our Predictions 2016 report, outlining eight shifts that banks and their partners can expect by December 31 of next year.

As a preview of the report, here are two of our predictions for 2016:

- APIs and open platforms will take center stage. APIs are becoming the most powerful technology in digital business design. Done right, APIs open new angles for business strategy. Financial services providers have been relatively slow to recognize and act on APIs as an opportunity to transform their businesses and, ultimately, better win, serve, and retain customers.* This will change in 2016, as digital executives collaborate with CIOs to champion big investments in internal, B2B, and product APIs. APIs won’t only help firms increase agility and provide services to clients and partners: They will enable financial firms to build dynamic ecosystems of value, reconnecting a fragmented value chain. They will be part of a wider, and longer-term, shift to open platforms as the foundation of digital financial services strategy.

- Real time will go prime time. The shift from batch to real time will advance dramatically over the next 12+ months. While it will not yet become fully mainstream, real-time data will become a reality across a wide swath of financial services markets. This will begin to impact everything from marketing to money movement, analytics to account aggregation, and a wide range of other bank and customer activities. Real-time data will enable expedited transfers and instant payments for bank, brokerage, insurance, and credit card customers — though in 2016, this will remain limited to certain segments or those willing to pay extra for the added convenience. Disruptors like Venmo in the US and Singapore’s Fastacash offer immediate, real-time value transfers between consumers. Not to be outdone, established firms like BBVA Compass in the US — in partnership with Dwolla — are enabling real-time payments and money movement.

To find out more about our predictions for digital financial services in 2016, you can read the full report. If you are a Forrester client, you can also contact your account manager or schedule an Inquiry to discuss these predictions further.

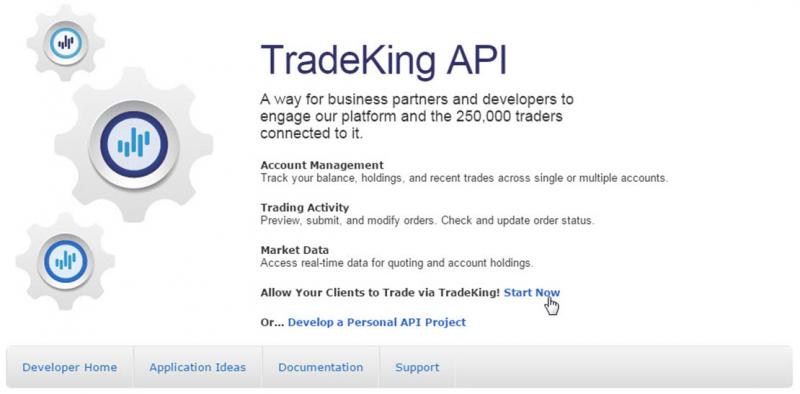

*There are a few exceptions, of course, such as BBVA in Europe and a number of direct brokerage firms such as TradeKing in the US (see image below). But even these leading firms will need to expand their use of APIs and move towards strategies that fully embrace open platforms and build dynamic ecosystems of value.