Highlights and Thoughts From Finovate Fall 2013

[note: this was written live last week while I was attending Finovate]

Greetings from the Big Apple! I’m here attending the fancy schmancy Finovate Fall 2013 conference featuring tech solutions and innovations from – and for – the financial services industry. Here are some of the offerings and presentations that stood out for me, in the order they were presented at Finovate:

- Kofax offers process automation software for lenders, but the big takeaway for me was their recent expansion of mobile, cross-channel, and multichannel analytics for financial providers. Focused on how customers shop for a loan, the dashboard and data are digestible and actionable. The jury’s still out, but strong analytics and easy-to-use tools can help banks improve sales in their lending lines of business.

- MoneyDesktop offers digital money management tools – also known as personal financial management or PFM – and their demo at Finovate continued to show their strengths: Nifty tools, clean design, and intuitive UI and UX. The question mark for banks, however, continues to be how well integrated – or better yet, embedded – the experience can/will be for end users.

- Yodlee’s new Tandem app tries to tackle “shared finances,” which encompasses everything from a son’s college tuition payments to an elderly mother’s electric bills. Private banking firms have dealt with these issues for affluent clients for years – these firms have focused on a similar need known as “tiered access,” which includes options such as giving a client’s attorney access to certain accounts while letting that client’s accountant view other accounts. Yodlee’s wisdom lies in offering something parallel to mainstream consumers. This is also a strategic move for the future, since aging baby boomers, complicated family structures, and a generation of digitally savvy consumers could well make “shared finances” a growing need in the near future. But while latent demand might well be on Yodlee’s side, it’s not clear whether a direct-to-consumer native mobile app – which is what Tandem is – will be the answer to consumers’ “shared finance” needs.

- SaaS Markets offers banks and FIs platforms for enterprise app stores. True, this is not the primary area of focus in my research. But it could be a big part of the future when it comes to how banks digitally engage small and medium-sized businesses, corporate clients, and employees. If banks want to truly become partners to SMBs – and/or engage employees – this offering could help them achieve that goal. In addition, the SaaS Markets’ revenue-sharing business model means a new revenue stream for banks.

- CR2 offers a range of tech solutions for banks, but the demo at Finovate focuses on helping banks transform their ATMs by updating the UI, enhancing the experience, expanding features, and – importantly – promoting cross-selling. Like many tech solutions firms at Finovate, CR2’s most immediate value is its insights: ATMs are a widely and frequently used banking touchpoint that remains – for the most part – stuck in the 1990s in terms of customer engagement and value to the bank.

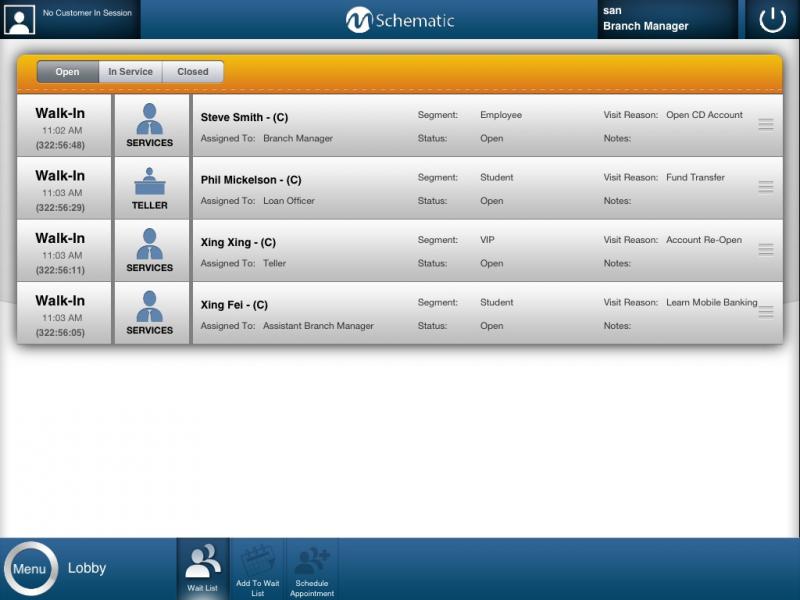

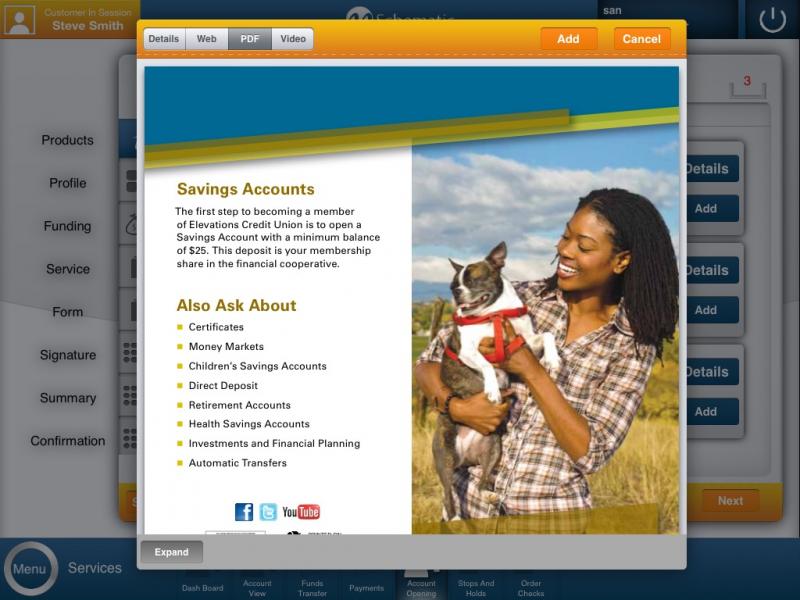

- Zenmonics is in the “digital transformation of the bank branch” business. This is a crowded field – a lot of tech solutions firms, plus a lot of pilots from banks – so Zenomics had two key insights: First, branch transformation is less about changing the actual branch and more about “changing the employee and the customer” (and it’s the bank’s job to enable the employee transformation); second, digital-in-branch is likely to succeed when a bank takes smaller, smarter steps (rather than trying to boil the ocean). As such, Zenomics offers an employee-facing tablet app for branch staff (see screenshots below). This app provides tellers, managers, salespeople, officers, and specialists with a “virtual lobby” of both scheduled and walk-in appointments. For each customer, the app offers widgets with views of their personal and account information, past behavior, product portfolio, and recent transactions – as well as the bank’s current product tree and cross-sell opportunities. Zenmonics is not a wholesale disruption – it won’t blow people’s minds – but it is a smart use of innovating the adjacent possible.

- Cardlytics, a well-known firm – at least for those of us obsessed with digital banking – used Finovate as an opportunity to showcase an update to its flagship innovation. The firm is doubling down on merchant-funded rewards with location-sensitive deals that are real-time. This white-label offering lets a bank offer unique, relevant offers to customers while also opening up a new revenue stream. The Cardlytics upgrade also includes in-app alerts – also known as push notifications – for customers enrolled in a bank’s merchant-funded rewards offering.

- Mitek, like Cardlytics, is a well-known tech solutions firm famous for an innovative white-label offering. Mitek is similar in another way: The firm used Finovate to demo an expansion of its core innovation. Mitek started by powering mobile remote deposit capture (RDC) for banks, and it now enables mobile photo bill pay for banks’ customers. At Finovate, Mitek showed off its new mobile photo account-opening solution for banks. A new customer – or a branch employee – can simply snap a picture of key documents, saving time, effort, and keystrokes.

Please share your comments below. If you are a Forrester client and want to hear more of my thoughts (on these and other innovations presented at Finovate), please reach out via Inquiry@Forrester.com

I look forward to hearing from you!

[here are some screenshots from the Zenmonics digital-in-branch tablet app]