Citibank Moves Boldly Into The Tablet Banking Market

Hotcakes, you've got some competition: the phrase "selling like tablets" might soon enter the global lexicon. And it's not all hype — though there is a fair bit of that as well. Tablet users in the US are estimated to grow at a compound annual growth rate (CAGR) of 51% from 2010 to 2015. That’s a fast-growing market for firms of all stripes.

As such, the tablet as a touchpoint is becoming a critical consideration for eBusiness & Channel strategists. This is especially true for executives at banks, as financial transactions benefit from the immediacy of the mobile channel, but users often struggle to make these transactions on smaller smartphone screens.

Enter tablet banking.

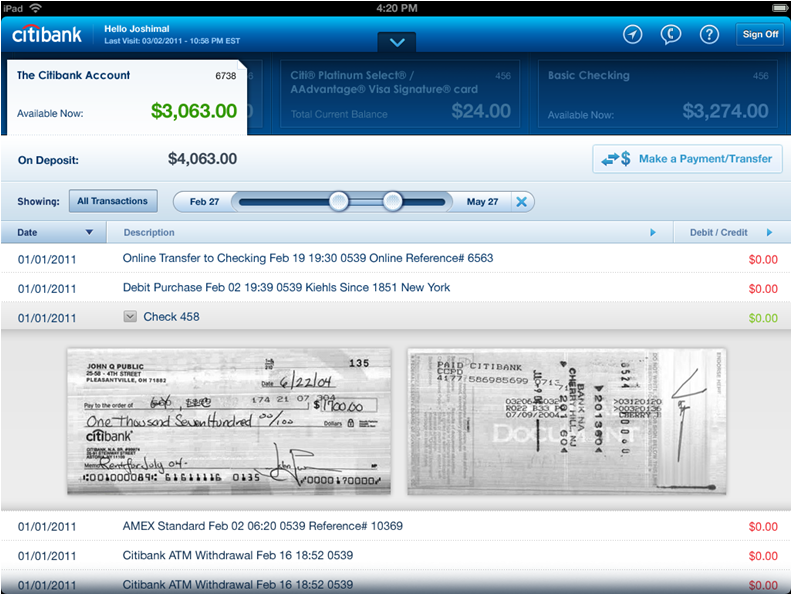

Forrester has previously identified best practices for tablet apps in financial services, but only in the past year have leading banks rolled out robust tablet banking efforts. One of the strongest tablet offerings we’ve seen is from Citibank.

In my new report, I outline the process Citibank went through in building its own tablet banking strategy, developing an iPad app, rolling it out to customers, and continually improving the service. We outline how Citi:

- Built the tablet app “from scratch.” The term “reinventing the wheel” is usually invoked with a negative connotation, and it’s true that businesses cannot afford to build their service from the ground up for every channel or touchpoint. But Citi’s eBusiness team made a conscious decision to build a tablet banking offering “basically from scratch.” According to Andres Wolberg-Stok, SVP of Strategy for Mobile and Emerging Technologies at Citibank: “We didn’t want to just go build a 2X bigger version of the mobile app . . . we didn’t want to be constrained by what has been done on other platforms or through other channels.”

- Pulled together a small cross-functional team. As in football and dogsledding, the makeup of the team is everything. The composition of Citi’s tablet banking development team was no different: The eBusiness leaders intentionally gathered just a dozen employees — a decidedly small team for Citibank — from a wide array of departments, locations, and positions. This included associates who’d been with the firm for a short time, as well as individuals with more than two decades of management experience at Citi.

- Used the occasion to rethink digital banking. Citibank’s existing retail online banking offering was certainly adequate. But meeting users’ expectations and exceeding them are two very different things. According to Tracey Weber, Managing Director, Internet and mobile banking at Citibank, “We wanted to fundamentally rethink customer interactions.”

The full report discusses the intricacies of Citi’s tablet banking strategy and its impact on the firm’s digital banking efforts as a whole.

Citi made key enhancements to the iPad app in December of 2011, including the rollout of PFM tools for credit cardholders and check images for deposit account customers (see below).

What do you think is next for tablet banking?