The State Of Digital Business 2016 To 2020

In the first in a series of reports examining the results of our latest survey on digital business, conducted in partnership with Odgers Berndtson, I look at executive perception of the impact of digital on their business.

It turns out executives are hugely optimistic about how digital will change their business. Forty-six percent of executives surveyed believe that in less than five years digital will have an impact on more than half their sales. This suggests not only huge awareness of the potential for digital to change today’s business but also an expectation that their company will be successful in making the transformation needed to bring this expectation to fruition. And it’s in the biggest companies, where change is hardest, that executives expect the greatest change.

In B2B industries like consumer packaged goods (CPG), wholesale sales, and professional services, the shift is expected to be dramatic — Forrester estimates that the US B2B eCommerce market will be $1.13 trillion by 2020.

- CPG execs expect digital to have an impact on almost half their sales. Even though the percentage predicted by 2020 is still less than 50%, if CPG companies were to generate anything close to 45% of their sales through digitally enhanced products and services or through online sales by 2020, it signals a dramatic shift in the CPG landscape. The ripple effects of the digitization of more and more CPG will be felt through wholesale and retail channels.

- Retail execs are bullish for online growth. While Forrester’s own research suggests that total US online sales will account for 13% of all retail sales by 2019, retail executives in our digital business survey are confident in their firm’s ability to use digital to boost revenue — predicting that digital will drive 58% of their sales by 2020. These numbers signal the rapid shift in perception among executives in what’s possible through digital. A full 12% of retailers in this survey expect to be 100% digital by 2020. Retailers not expecting the kind of shift that’s suggested in these latest numbers are likely to become digital prey to more nimble digital predators.

- Professional and business services face dramatic changes. Execs in professional services expect 49% of revenue to come through digital channels or products by 2020 — a big difference from the 20% in 2014. While some of this shift will likely come through selling professional services online, I predict an increasing number of professional firms will develop revenue-generating digital products — such as Forrester’s interactive dashboards — alongside their traditional services.

- Industrial products are catching up. Up to now, the industrial sector has seen less disruption from digital, but executives expect this to change. Even coming close to the 37% of revenues predicted by 2020 would require a major change in how companies develop and distribute industrial products — but this is exactly the kind of disruption General Electric (GE) predicted, which it describes as the industrial Internet. As industrial components and machines become digitized, sending streams of data to manufacturers and suppliers, we’ll see a new range of digital services emerge that help businesses optimize their assets. The agricultural sector is an example of the kinds of change that are possible — instead of just selling seeds and fertilizer, companies like Pioneer already successfully augment sales with new data-enabled digital services.

To read more check out the full report here.

Some Key Takeaways

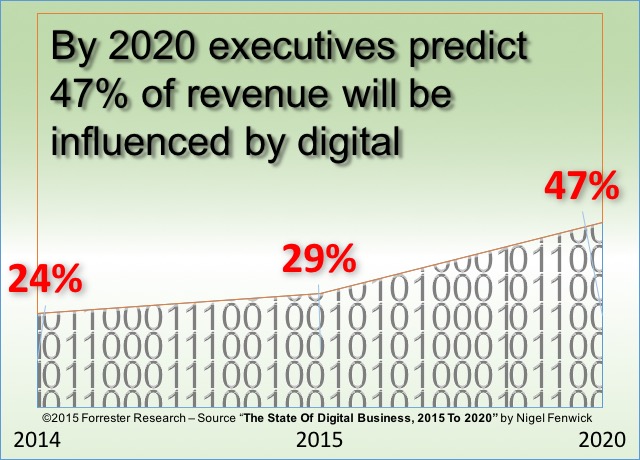

Revenue Will Quickly Move To Digital

Digital is approaching a tipping point. Over the next five years, companies will begin to see digital affect the majority of their revenues. Most of today’s companies are unprepared for this change.

Firms Need A Better Digital Talent Acquisition And Retention Strategy

As the risk to existing revenue streams becomes apparent, companies will begin a panicked effort to attract digital talent. Companies with a strategy to attract and retain top digital talent will have an advantage in the face of a massive shortage of talent.

- Previous post: Microsoft PowerApps Aim To Unlock Employee Innovation

- Next post: Unleash Your Digital Predator