The Ultimate Question

As fans of The Hitchhiker’s Guide to the Galaxy will recall, the answer to the ultimate question of life universe and everything is something a group of hyper-intelligent pan-dimensional beings demand to learn by building the ultimate computer — Deep Thought. It takes the computer 7.5 million years to compute and check the answer.

Of late I’ve been considering a more mundane version of the ultimate question — what is the ideal metric to use when evaluating business technology strategies? The challenge is that we already have a diverse set of investment metrics from which to choose. There’s Return On Investment (ROI), Net Present Value (NPV), Internal Rate Of return (IRR) and Payback period to name a few of the most common. Yet I can’t help feeling they all lack a little something — the ability to connect the project with the desired business outcome, which for a strategy is the attainment of the goal.

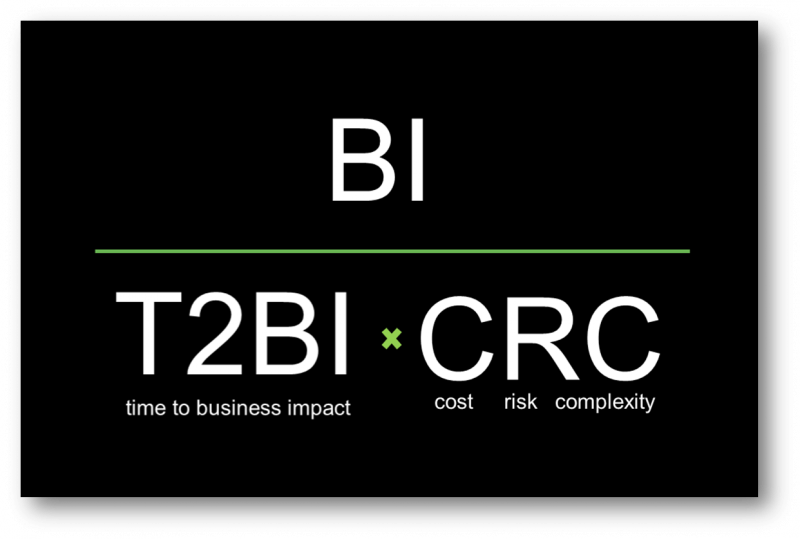

Recently I’ve been working with clients to apply a different measure — the T2BI ratio:

This takes into account both the business impact of a strategy and the time it takes to achieve the desired business impact into account. By multiplying the time-to-business-impact by a score for cost * risk * complexity, we end up with a useful ratio which helps select the best strategies to achieve the goals while also taking into account today’s reality (reflected in the cost/risk/complexity score).

I’ll be discussing this and other aspects of business technology strategic planning at next week’s CIO Forum in Paris. I hope to see you there. In the meantime, I’d love to hear your thoughts on the T2BI ratio — would it work in your organization? If not, why not and what other measures are you using instead?

Next post: What Business Are You In?

Previous post: It’s Time To Kill Your IT Strategy