Sophisticated Online, Internet, And Mobile Banking Solutions Help Banks Differentiate And Contain Costs

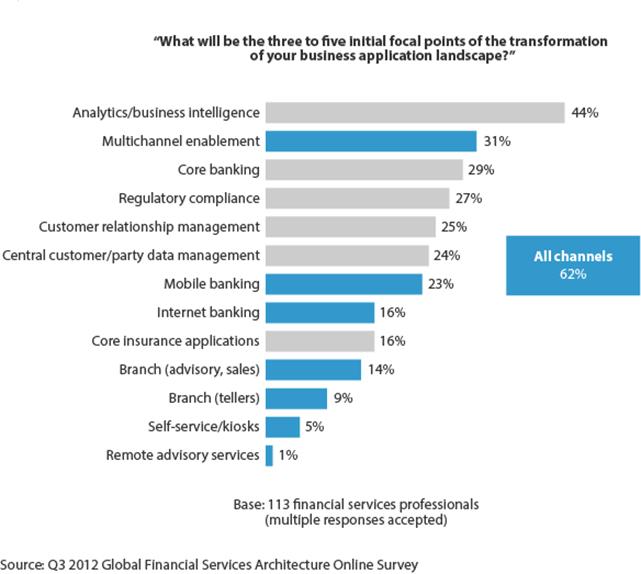

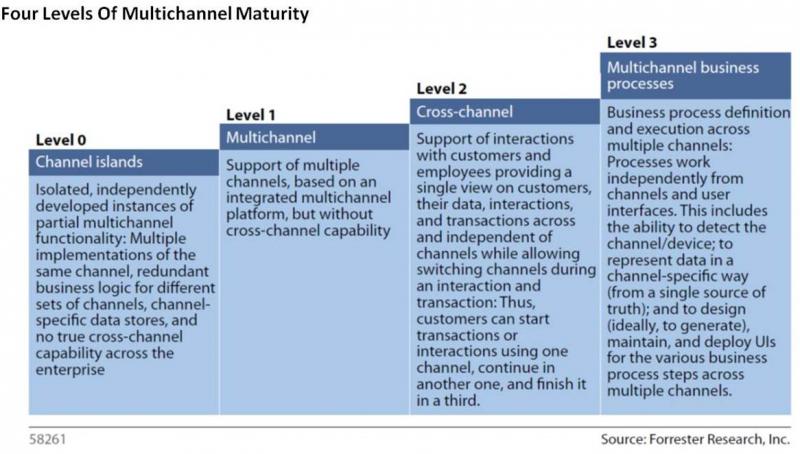

The bank I mainly use for my daily banking needs does not offer that many examples of great customer experiences. The two reasons why my family continues to use that bank are the high number of ATMs in the area where we live and a very customer-oriented branch advisor. Our most recent interaction with that bank (but not with that advisor) delivered yet another example of “great” customer service across channels, an experience that will likely cause us to look for a new bank. The chances that this yet-to-be-determined bank can offer better cross-channel capabilities at least at some point in the future are not bad at all: Many financial services firms are evolving beyond using just a single channel to get in touch with their customers (see the figure below).

They can’t afford to have channel “islands” anymore and are moving beyond “simple” multichannel solutions toward solutions that offer cross-channel interactions and transactions. Ideally, these solutions support business processes across channels (see the figure below). While many banks have clearly identified the need for broad and rich multichannel solutions, more often than not the need for speed has driven them toward solutions that support just one channel — often the mobile channel. At the same time, financial services firms have identified cost containment as one of the key drivers for changing their app landscape — and the cost of change as one of the key obstacles to transformation. Therefore, firms are seeking the most cost-effective way forward, making it less likely today than in the past that they will favor custom-built software.

Our market overview of Internet, online, cross-channel, and mobile channel solutions shows that most off-the-shelf (OTS) solutions can cope with many of the typical requirements of banks. A few solutions even show high sophistication across many business and technology areas — so even more advanced banks can find capable OTS channel solutions that can help them contain costs.

Banks with highly advanced or specialized requirements should use a business case to determine whether a full-blown custom-built channel framework will pay off quickly, only over a long period of time, or not at all. Channel solutions are among the more volatile and short-lived elements of banks’ app landscapes, so banks should also compare whether the best-suited OTS solutions will improve (via the delivery of road map items) until the bank has a custom-built framework ready to go.

Please let me know what you think. I am highly interested in your thoughts: JHoppermann (at) Forrester.com.