Context Matters, And That Means Your Industry

It’s likely not news to you that your business context matters. Your vendors and services providers must understand the reality you’re doing business in. They’ve got to have the experience and knowledge to intelligently "speak the language" of your internal stakeholders, identify relevant insights, and recommend appropriate actions. And that means knowing the industry in which you operate. And, that’s even more so for someone providing you with the insights you need to improve your business.

Some of these industry differences include:

- Top priorities. Although business priorities are often similar, each industry pursues them with varying levels of urgency. Decision-makers in retail see improving customer experience as a do-or-die requirement, with 80% reporting that it's a high priority over the next 12 months; in oil and gas, only 49% report that it's a key area of focus. Under intense competitive pressure, telecoms look to reinvent themselves: Over two-thirds of decision-makers report that improving innovation is a high priority, while only 47% in healthcare say it's a top initiative.

- Strategic objectives. Strategies for growing revenue, a unanimous priority, vary greatly by industry. Decision-makers in the consumer goods industry emphasize acquiring new customers as well as launching and selling new products over retaining, upselling, and cross-selling to current customers. In contrast, decision-makers at financial services firms see enriching current customer relationships as key to growing revenues. Other verticals, like utilities and primary production, have a greater appetite for pursuing new opportunities in emerging markets. Yet only a quarter of decision-makers in retail responded that this initiative was on their firms' agenda. It is clear that one approach doesn't fit all industries.

- Business environments. Digital disruption upends industries in different ways: Brick-and-mortar stores face immense pressure from online retailers; car manufacturers, insurance companies, and transporters fear self-driving vehicles. Other industries, such as financial services and pharma, operate under intense regulatory constraints. And some industries must react to erratic economic conditions: Oil and gas is confronting decreasing commodity prices and depleting reserves. Insights service providers with extensive industry experience have the expertise to distinguish which dynamics matter.

- Data maturity. Not all industries have benefited equally from the insights revolution. They differ widely in their data and analytics capabilities, competencies, and culture. Some struggle to attract, hire, train, retain, and grow business intelligence talent. Others haven't invested as much in building advanced predictive analytics systems or implementing self-service data visualization tools. A few verticals generally lack an awareness and appreciation for the value of data and analytics — a data culture — often due to variations in data leadership. Ultimately, data and insights are only meaningful if they inform decisions. Data and analytics decision-makers in some industries report that their firms do a better job of using quantitative information and analysis for making decisions than others.

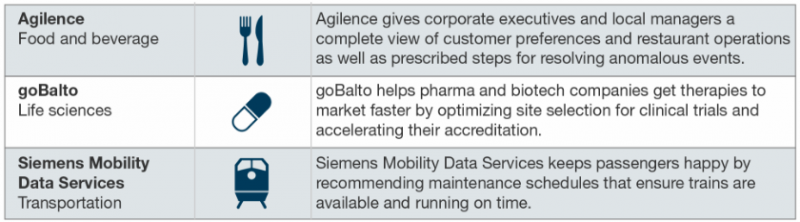

Our recent report on industry-specific insights service providers profiles three breakout vendors who have developed offerings that address the unique contexts of specific industries: pharmaceuticals, food and beverage, and transportation. These vendors understand the importance of deep vertical expertise to their customers. While many of the industry-specific vendors remain small, larger players in the insights services market are actively looking to expand their ecosystems. For true business insights industry matters.

Our recent report on industry-specific insights service providers profiles three breakout vendors who have developed offerings that address the unique contexts of specific industries: pharmaceuticals, food and beverage, and transportation. These vendors understand the importance of deep vertical expertise to their customers. While many of the industry-specific vendors remain small, larger players in the insights services market are actively looking to expand their ecosystems. For true business insights industry matters.