The Global Software Market In Transformation: Findings From The Forrsights Software Survey, Q4 2010

Two months ago, we announced our upcoming Forrester Forrsights Software Survey, Q4 2010. Now the data is back from more than 2,400 respondents in North America and Europe and provides us with deep and sometimes surprising insights into the software market dynamics of today and the next 24 months.

Two months ago, we announced our upcoming Forrester Forrsights Software Survey, Q4 2010. Now the data is back from more than 2,400 respondents in North America and Europe and provides us with deep and sometimes surprising insights into the software market dynamics of today and the next 24 months.

We’d like to give you a sneak preview of interesting results around some of the most important trends in the software market: cloud computing integrated information technology, business intelligence, mobile strategy, and overall software budgets and buying preferences.

Companies Start To Invest More Into Innovation In 2011

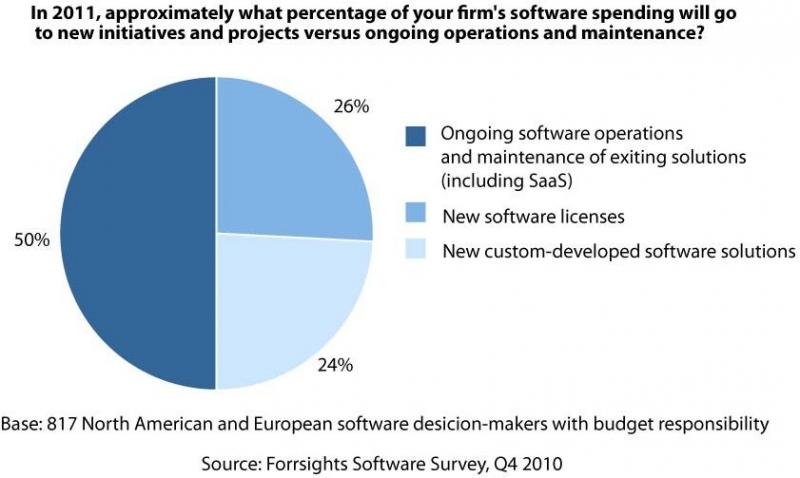

After the recent recession, companies are starting to invest more in 2011, with 12% and 22% of companies planning to increase their software budgets by more than 10% or between 5% and 10%, respectively. At the same time, companies will invest a significant part of the additional budget into new solutions. While 50% of the total software budgets are still going into software operations and maintenance (Figure 1), this number has significantly dropped from 55% in 2010; spending on new software licenses will accordingly increase from 23% to 26% and custom-development budgets from 23% to 24% in 2011.

Cloud Computing Is Getting Serious

In this year’s survey, we have taken a much deeper look into companies’ strategies and plans around cloud computing besides simple adoption numbers. We have tested to what extent cloud computing makes its way from complementary services into business critical processes, replacing core applications and moving sensitive data into public clouds.

We found that more than 44% of companies are currently implementing or planning to implement software-as-a-service (SaaS) solutions — 29% for infrastructure-as-a-service (IaaS) and 25% for platform-as-a-service (PaaS). Of those, only 20% are planning to actually replace existing on-premise solutions with public cloud SaaS services, and 80%will instead complement existing investments. The survey results include much more detailed insights, such as the differentiation between front-office and back-office applications and results for all software segments from enterprise resource planning (ERP) to industry-specific solutions.

Companies Don’t Care About Pre-Integrated Hardware/Software Solutions (At Least In 2011)

Several large vendors like IBM and Oracle are investing through acquisitions and development to offer pre-integrated hardware and software solutions for better performance and faster implementation times. But do customers actually care about single-vendor, pre-integrated solutions? No, not really, at least not yet in 2011! Our survey reveals that only 7% of all companies buy into the story and would prefer to purchase single-vendor, pre-integrated solutions; however, 25% prefer to follow a best-of-breed strategy, and 38% have no preference at all.

Business Intelligence Is The No. 1 Priority Software Application In 2011

Business intelligence (BI) software has been a hot topic for the past few years and in 2011, BI will again be in the focus of company’s software investment plans. More than 49% of all companies that responded to our survey have concrete plans to implement or expand their use of BI software within the next 24 months (closely followed by collaboration software with 48%). Not surprisingly, standard reporting and data visualization are still on top of BI implementation plans (59% of all companies surveyed having concrete projects for these) but more advanced analytics, such as predictive analytics (33% of all companies do have concrete plans) are catching up.

Companies Are Building Their Own Customer-Facing Mobile Applications

With the lack of suitable mobile solutions from standard software vendors, 51% of all companies that responded to our survey are currently in the process of developing or have concrete plans to develop their own customer-facing mobile applications, such as mobile commerce or mobile marketing. And it’s not third-party experts that are mainly doing the job. Of all companies, 78% are using their in-house developers for building their mobile applications; only 15% are using offshore consultancies (e.g., TCS, Wipro), and 11% are using traditional system integrators (e.g., Accenture, IBM).

The Software Market Shifts To Subscription-Based Licensing

In 2011, we will see companies continue to move away from traditional licenses models toward more flexible licensing forms such as subscription-based or pay-per-use licensing. While in 2010 75% of license budgets were spent on traditional licenses, in 2011 this number will drop to 71%; at the same time, subscription fees and pay-per-use models will grow from 15% to 22% of the total market in the coming year.

Of course, this is no more than a snapshot of what is covered in this latest software survey. We significantly boosted the sample size this year for the energy (oil and gas, utilities, and mining) and healthcare industries and can provide an in-depth analysis for these industries along with retail, financial services, high-tech, and other industries, as well as for different regions and countries in North America and Europe. Clients of Forrester’s Forrsights for Business Technology can request the data right away, while non-clients can get in touch with me or with our Data Advisor Team to discuss further opportunities.

In addition, please look out for a more comprehensive Forrester report with the key findings from the Forrester Forrsights Software Survey, Q4 2010, early next year.

Please leave a comment or contact me directly.

Kind regards,

Holger Kisker