Dell Services In The Post-Privatization Era

I attended Dell’s third annual global summit last week at the company’s headquarters in Austin, Texas to get an update on the company’s progress since it went private. The event demonstrated Michael Dell’s passion to transform a hardware company into an end-to-end solution provider. Dell highlighted five key investment priorities in 2014, including expanding its sales coverage and enhancing its relationship with partners; it also wants to increase its investments in emerging markets, with China atop the list.

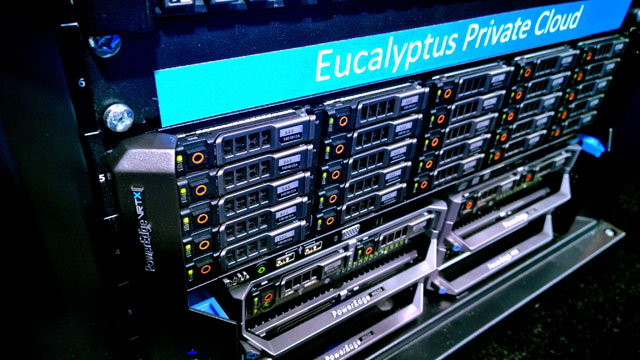

The success of these investment plans hinges upon highly efficient execution across the organization. We’ve already seen one example that Dell has increased its executive capability since it went private: Its partnership with open source software provider Eucalyptus to put preinstalled and pretested Eucalyptus software on Dell VRTX servers. This project was ready just three weeks after CEOs of Dell and Eucalyptus decided to go forward with the partnership.

On one hand, the improved execution capability and more flexible service delivery model will strengthen the competitive position of Dell’s services. On the other hand, these changes will also provide benefits to end user organizations, including:

- A long-term relationship with a Dell that is more open to long-term outsourcing contracts. Free from short-term pressure on revenues and profits, Dell services can develop client relationships that stretch beyond the usual five-year contract. Had Dell signed a lot of long-term contracts before privatization, its financial report would have been ugly — because the company usually loses money in the first two years of a long (e.g., five-year) contract, realizing margin on the project only after the fourth year. This constraint is now gone.

- Strengthened local consulting and support services, particularly for remote business in emerging markets like China and Africa.When Dell was a public company, its services arm reserved its investments for operational expenditures like people — which differed significantly from the rapid, capital expenditure-driven expansion of its hardware business in emerging markets. After privatization, Dell services can accept a longer cycle of ROI on services and be more patient in developing and maintaining clients in immature markets. Companies operating in emerging markets will soon find more local bandwidth and alternative options from Dell services.

Dell services do still have their limitations, as they currently focus on solutions for two industries: healthcare and banking finance. If your company isn’t in one of those verticals and you’re looking for an industry-specific solution, you should probably consider other alternatives on your vendor shortlist.