Chinese Tech Management Pros: Start Looking Closely At Domestic IT Vendors

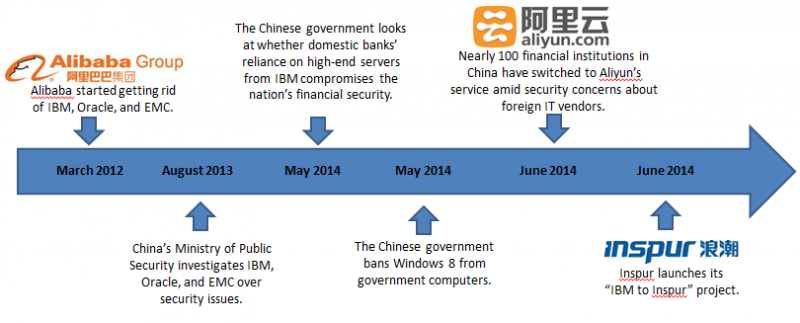

Several events over the past few months in China will affect both the IT procurement strategy of Chinese organizations and the market position and development of local and foreign IT vendors, including:

- A government-led push away from foreign IT vendors. Amid security concerns, the Chinese government has issued policies to discourage the use of technology from foreign IT vendors. As a result, many IT and business decision-makers at state-owned enterprises (SOEs) and government agencies have put their IT infrastructure plans — most of which involved products and solutions from foreign IT vendors — on hold. They’ve also begun to consider replacing some of their existing technology, such as servers and storage, with equivalents from domestic vendors. This is significant given that government agencies and SOEs are the key IT spenders in China.

- A trend to get rid of IBM, Oracle, and EMC. Alibaba was an early mover, replacing its IBM Unix servers, Oracle databases, and EMC storage with x86 servers, open source databases like MySQL and MongoDB, and PCIe flash storage. This has evolved into replacing these foreign products and solutions with ones from local Chinese vendors. For example, Inspur launched the I2I project to stimulate customers to drop IBM Unix servers in favor of Inspur Linux servers to support business development. The Postal Savings Bank of China, China Construction Bank, and many city commercial banks have started deploying Inspur servers in their data centers. However, this only affects the x86 server and storage product market: While domestic vendors can provide x86 servers and storage, they still have no databases to replace Oracle’s.

These trends have negatively affected the business performance of foreign IT vendors like Cisco, EMC, IBM, and Oracle in the Chinese market and presented local vendors with significant new opportunities. Both Inspur and Huawei have grown rapidly in the past months, and Lenovo sees a good year ahead, once it completes the acquisition of IBM’s x86 server business.

Tech management pros at more and more Chinese organizations are taking these trends into account in their IT spending plans. What do I&O pros and CIOs in China need to know?

- Go domestic when developing new business. For many large organizations, particularly government agencies and financial institutions, moving existing critical IT infrastructure, such as a core banking system, to a new platform is very risky. However, for infrastructure associated with new business initiatives — for example, a traditional bank developing Internet finance to reach more customers — consider using products from domestic vendors or adopting commercial open source solutions like Red Hat Linux.

- You can’t replace all foreign products and solutions. So far, Chinese vendors can only provide x86 server and low-end storage products to replace foreign IT vendors’ products. For example, Huawei can provide comprehensive x86 server, storage, data center networking, and converged infrastructures and has some local and global customer references. Lenovo (which acquired IBM’s x86 server business) and Inspur only provide x86 servers; their storage products’ capabilities are still too limited to replace offerings from established foreign vendors. Finally, in key areas like mainframe computing, applications, and databases, there are almost no domestic vendor alternatives.