Strengthening The Link Between Software Sourcing And Supplier Management

I’m part of a team called “sourcing and vendor management” (SVM). Forrester organizes its research teams by individual client roles, so my teammates and I all focus on helping clients who are sourcing and vendor management professionals. Wait a moment. Should that read “helping clients who are sourcing or vendor management professionals”? Aren’t they separate functions within a client’s organization? This is a frequent question from our clients, and one that causes a lot of internal debate within our team.

My view, formed from witnessing the experience of hundreds of enterprises, is that, at least in the software category, sourcing and supplier management should be very closely linked, but not via org structure and reporting lines. This is because:

· It is impossible to manage software suppliers effectively unless you can influence sourcing. The major players are so big and powerful that they usually have the upper hand in discussions about maintenance renewals and service levels. Even small software providers can build immovable, entrenched positions in their chosen niches. To have sufficient negotiation leverage to do a good job, the supplier manager must be able to credibly threaten to negatively impact the supplier’s ability to win future business.

· Sourcing is infrequent but intensive, whereas supplier management is continual. The former consumes huge amounts of time and effort for a relatively small period, which risks dropping the ball on monitoring while you’re immersed in a big negotiation, or missing opportunities on the sourcing side due to distractions from the ‘day job’. You therefore need different people handling each side, but collaborating closely with each other.

The Strategic Software Sourcing Playbook explains how to build this connection, by creating formal categorization of your software suppliers and using it to influence software category sourcing strategies. As part of this playbook, we’ve just published Forrester's Supplier Partnership Assessment Model, which you can use to drive this categorization by measuring the key attributes that identify your best suppliers. Not only can Sourcing use this to favour the top tier in product decisions, Supplier Management can also use it provide real leverage, by offering to help them win new business by improving in specific areas and by threatening to downgrade them if they fail to rectify their deficiencies.

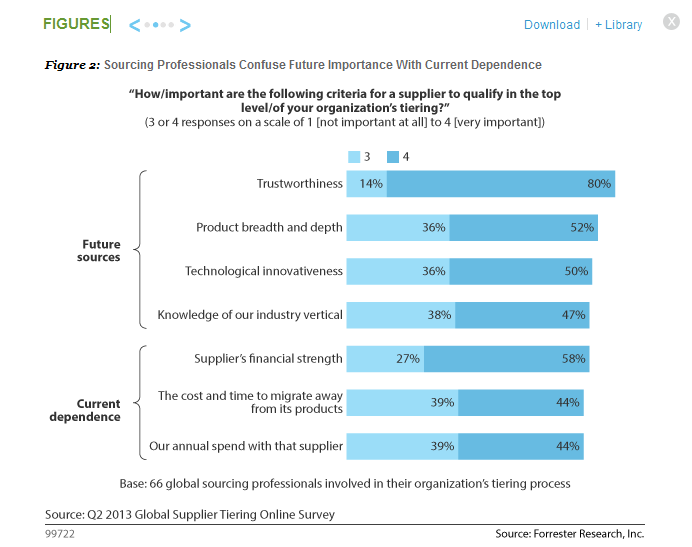

As we explain in the accompanying report Use Forrester's Software Supplier Tiering Framework To Increase Your Negotiation Power very few sourcing groups do this effectively, most confusing the need to allocate limited supplier management resources with the need to identify and reward the best sources for new projects. As a result, most mix up forward-looking criteria with ones that measure their current dependence on a supplier, thereby creating a misguided evaluation system that accentuates powerful incumbents' existing negotiation advantage and also overlooks high-performing innovative suppliers who deserve upgraded status. (see Figure 2 from the report).

Bottom line: software sourcing and supplier management are distinct disciplines, but enterprises should link them with a forward-looking supplier categorization system that identifies the best sources of new products and favors them in future sourcing decisions.