2013 Huawei Global Analyst Summit: welding together networks, devices and services

Dane Anderson, Dan Bieler, Charlie Kun Dai, Chris Mines, Nupur Singh Andley, Tirthankar Sen, Christopher Voce, Bryan Wang

Huawei is one of the most intriguing companies in the ICT industry, but its overall strategy remains largely unchanged: imitating established products and services, then adjusting and enhancing them, and making them available at an attractive price point. But to be fair: Huawei is pushing more and more innovative products.

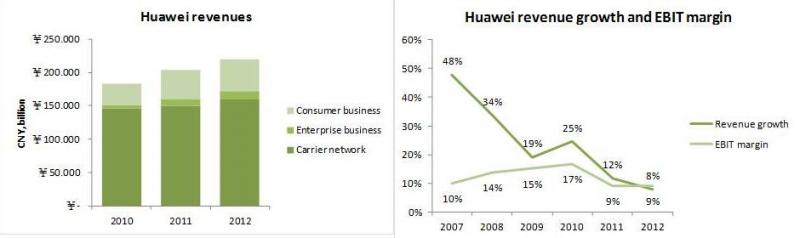

In 2012, Huawei’s annual revenue growth slowed down to 8% to CNY 220 billion (about US$ 35 billion). During the same period, its EBIT margin remained flat at 9%, despite the changing revenue composition due to the growth of its consumer and enterprise business. Unlike last year’s event which was dominated by the announcement to push into the enterprise space, this year’s Global Analyst Summit in Shenzhen saw little ground breaking news. It was more of a progress report:

- The Enterprise Business division is the future growth engine. In 2012 the enterprise business unit was "not as inspirational" as Huawei expected, growing “merely” at 26%. As it turns out, selling to enterprise clients is not as easy as putting carrier products in front of them. At the event Huawei "adjusted" its expectations for enterprise revenues from $15 billion to $10 billion by 2017. Cloud infrastructure, including storage, and VDI, form the focus of Huawei’s network activities. In order to be successful, we believe Huawei needs to strengthen its service capabilities and provide more reference architecture and vertical-specific application scenarios. Meanwhile, the US remains a challenged market for Huawei. Better transparency and governance will help Huawei to penetrate the US market. But we believe old-fashioned capitalism is key: if Huawei has better solutions at better prices, it will overcome many political and security concerns that enterprise customers might have.

- The Carrier Business still accounts for three quarters of total revenues. The carrier business grew at 7%, up from 3% growth in 2011, indicating that Huawei is taking market share from other network vendors. One highlight is Huawei’s Single RAN, a standard-setting technology that allows wireless carriers to use a single system across multiple frequencies. Although enterprise products, UC and contact center solutions are sometimes sold through carrier channels. Huawei is ramping up its distribution channels in regions outside China, strengthening local teams and investing in marketing. Huawei plans to enhance its mobile UC offering, expand its SMB solution, integrate location based emergency services, and enable video voice mail. Huawei also aims to strengthen software-based contact center solutions and push panoramic telepresence.

- The Consumer Business helps Huawei develop brand identity. Having become the world's third-largest smartphone vendor behind Samsung and Apple in Q4 2012, Huawei is clearly making some inroads in the consumer segment. The main focus for the Consumer Business is on customer experience, in particular its Emotion UI as well as the Unified UI for its consumer cloud activities, which aims at the broader home area networking market. The consumer division may also offer an interesting path to overcome some of the concerns regarding national security by broadening its brand identity, particularly in the US.

Any snapshot view of Huawei must keep in mind that its ambitions are very long-term in nature. Huawei itself said that no single provider so far has managed to succeed in all three areas that Huawei is targeting now: carrier networks, enterprise infrastructure, and consumer devices. To succeed Huawei needs to:

- Refine its channel strategy. Although the share of direct sales has gone down from 55% to 34% last year, Huawei still uses direct sales and its high touch model to approach large enterprises, especially the named accounts. Overall, we are impressed with the progress of Huawei’s channel strategy. Last year, Huawei did not have any value proposition for channel partners. This year, Huawei has well documented value proposition for its partners, along with plans for the future. We see a structure in Huawei’s partner program, especially in the IT services model, which brings an added revenue stream for the partners. Huawei also invested in various channel enablement and assessment tools for bringing in transparency and streamlining the processes with its partner community. Huawei is also working towards developing its alliances and ISV relationships. But Huawei needs to further localize its channel strategy and staff, incorporating local culture in their go-to-market strategies.

- Sell solutions and move beyond Huawei's traditional engineering hardware pitch. In some areas, Huawei already focuses on solution innovations that are aligned to industry-specific requirements. For instance, its Virtual Teller Machine (VTM) automates basic banking operations such as card activation, application submission and customer care, thus offering client service and video conferencing facilities for enhanced customer collaboration. But more of that type of solution needs to be pushed. Also, Huawei needs a lot more executives who truly understand both mainland Chinese and Western business cultures and processes. It also needs to ensure that they are truly embedded into the decision-making structure of the management team.

So what is the best analogy to understand and predict Huawei’s future path? Will Huawei encounter the same struggles overseas that Japanese players like Fujitsu, Hitachi, and NEC did for years? Or will Huawei follow Ericsson’s or Nokia’s path that parlayed network strength into the enterprise and consumer markets with some global success. Maybe Lenovo provides a better model by dominating a "box" business while taking down some formidable competitors. Most likely, there will be elements of all three scenarios in Huawei’s future. One thing is for sure: Huawei is here to stay.