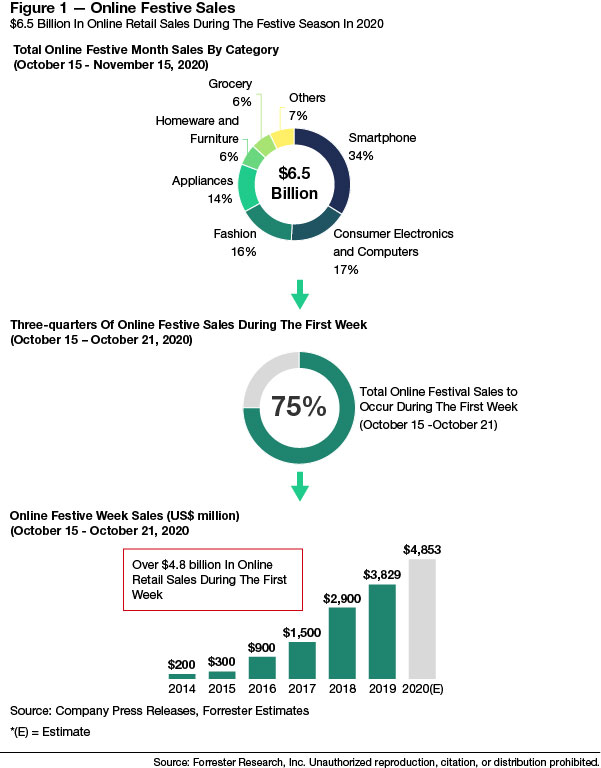

Holiday 2020: India’s Festive Season Will Generate $6.5 Billion In Online Sales

Online retailers in India are expected to generate about $6.5 billion in sales during this year’s festive month (October 15 to November 15), with around 55–60 million online buyers participating (see Figure 1). About 75% of these sales will occur from October 15 to October 21, the period in which Flipkart will hold its Big Billion Days event, while Amazon’s Great Indian Festival event will start on October 17. Year-over-year growth in online retail spending during the festive month will see a growth of 34%. Other highlights for this year’s festive season:

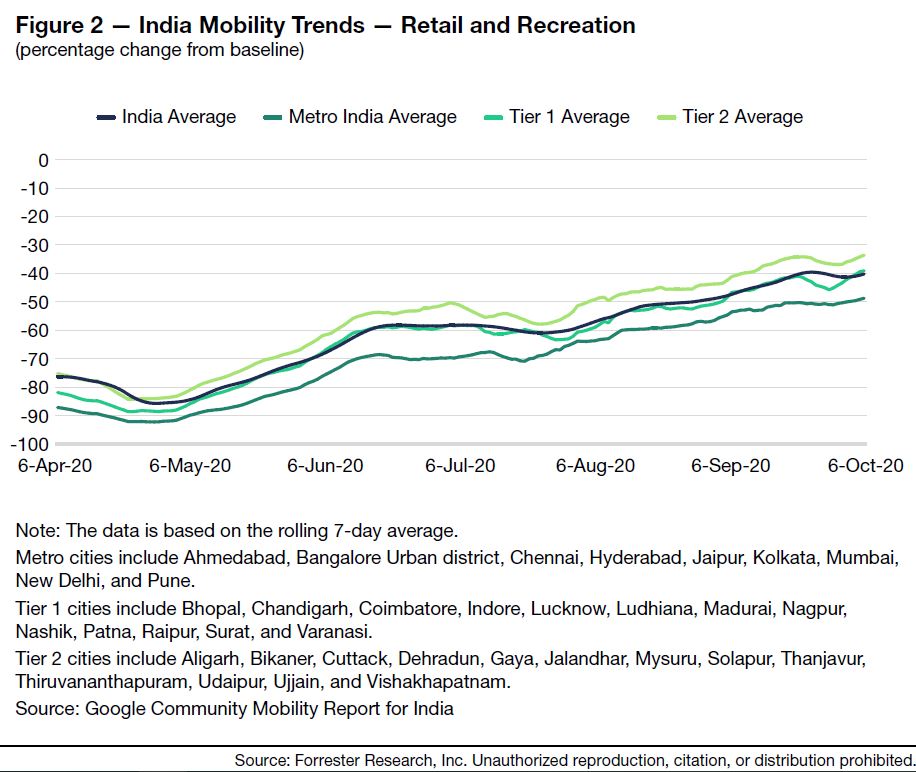

- Mobility trends indicate a slow return of economic activity. Google’s Mobility Report indicates how disruptive the impact of COVID-19 and the ensuing lockdown was on population movement. Retail- and recreation-related mobility declined by 90% in metro areas for the month of April; the effect on tier I and tier II cities was slightly less severe, at 86% and 80%, respectively. This also meant that there were job losses, and the demand for nondiscretionary spending took a back seat. Fast-forward to September, and we notice a marked improvement, with mobility recovering by at least 40% for all cities, with tier 2 cities leading the charts (see Figure 2). Of course, it is still quite far away from the level of movement before the pandemic, but it is undoubtedly better and points at slow resurgence in economic activities. While we are optimistic about the online channels doing well during this holiday season, some of it will come at the expense of offline retail.

- A fundamental shift in buying behavior will occur. The current crisis has transformed buying behavior, with general averseness to go out; consumers have latched on to online channels. The inhibitions of buying online are gone, and a transformation that would have taken two years has happened in five months. Indian economic contraction will be more severe than previously anticipated, with the latest forecast projecting a decline of 10.3% in GDP for 2020 compared to the forecasted decline of 4.5% released in June. The economic downfall also means job losses and erosion in consumer confidence. With sharp contraction in the economy and a pressured job market, consumers flocked to online channels to get the best bargains. Some pent-up demand from the lockdown period was let out during the Prime Day sales event in August; we expect a lot of demand in consumer electronics, home appliances, smartphones, and home furnishing to drive more sales during the festive month. We also expect an increase in share of purchase from tier 2 and 3 cities due to migration of employees to smaller cities as offices are closed.

- Marketplaces are gearing up for a festival bonanza. E-tailers will be actively addressing increased online demand on multiple fronts, with e-tailers and online sellers making big investments to ramp up infrastructure, workforces, and technology across lower-tier cities and metropolitan areas to drive overall fulfillment. This year, Amazon has set up 10 new fulfillment centers; with these additions, it will have 60 fulfillment centers across 15 states in the country. We also see strong traction in terms of growth for its online seller base: Amazon has reported 30% growth for online merchants as compared to last year and a 60–80% increase in new seller registrations since February; most of these are likely to be micro, small, and medium enterprises, which are increasingly recognizing a greater potential for sales as the pandemic drives more people to shop online. Attractive festive deals and product discounting along with flexible payment options will boost affordability for consumers, hence making it another successful festive-year period for e-tailers in India.

- Smartphones remain the largest category; grocery is growing the fastest. Smartphones and consumer electronics will grow at 26% and 43%, respectively. Smartphones and consumer electronics will do well, as consumers typically wait for the festive season to upgrade their devices to coincide with new phone launches in India. Themed around price sensitivity, we expect new launches to drive volume in both the smartphone and appliances categories. OnePlus is launching a new, affordable TV Y series in India, to debut on the first day of festive sales. Grocery will emerge as the fastest-growing category, as most of the festive-themed categories within grocery move online, aided by the increase in basket size during this period, as well as the buzz created by JioMart. Fashion, the third-largest category, is expected to contract by 9% this holiday season compared to last year. With consumers stuck at home, occasion-based clothing shopping will remain subdued this season.

- Flipkart will play on its lead in smartphone and fashion categories; Amazon will rely on Prime members. Since its launch in 2014, Flipkart has led spending during the festive month due to its strength in the smartphone and fashion categories, which account for around 50% of total online retail sales in India. This year, Flipkart has also launched 22 smartphone models since mid-September to maintain the lead. Meanwhile, Amazon is focusing on its Prime members to buy in more categories and buy more frequently during this month. Hence, the Great Indian Festival will run for the whole month until Diwali. During festive month 2020, smartphone and fashion will account for 50% of total sales, allowing Flipkart to maintain the lead.

We will be updating our online retail forecast for India in Q1 of 2021. Meanwhile, for more detail on the future of the Indian online retail market, ForecastView clients can access our online retail forecast for Asia Pacific.