Consumer Energy Steadies Overall, Pulses In Certain Regions

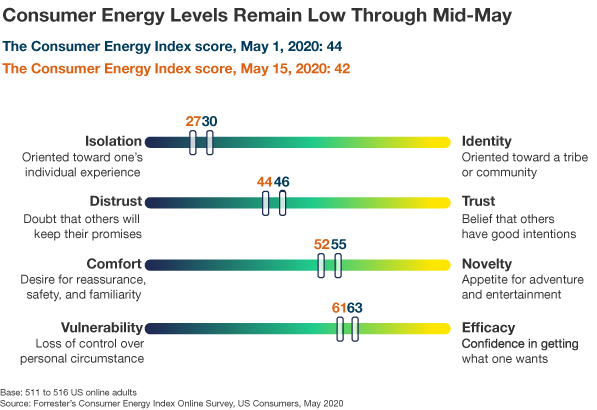

To measure precisely what kind of emotional toll COVID-19 is taking on consumers — and how current consumer sentiment will influence imminent behavior — we are applying Forrester’s Consumer Energy Index, our data-driven framework that captures how ready and willing consumers are to reach out to brands.

Overall consumer energy dropped dramatically during the months of March and April as the COVID-19 pandemic became a harsh reality across the US. By the end of April, consumer energy hovered at its lowest numbers and showed early signs of a gradual rebound. The latest read reveals that baseline consumer energy levels are steady in mid-May.

What The Data Means

At this moment:

- Consumers continue to feel disconnected and struggle to identify with brands. Since early March, “identity” scores have hit the lowest levels in our two years of consumer energy measurement. The latest results show that consumer energy along this dimension not only remains low but is also the slowest to recover. Stay-at-home orders and physical distancing have driven consumers into emotional isolation — of all four dimensions, brands will have to work the hardest to dial up consumers’ sense of community.

- Consumers remain cautious about trusting organizations. Consistently low consumer trust levels reflect consumer skepticism toward brands’ intentions. As consumers grapple with disrupted lifestyles and an uncertain future, they continue to be wary about companies’ ability to follow through on promises and make decisions in the consumer’s best interest.

- Consumers feel the tension between the longing for familiarity and appetite for novelty. During the past two months, consumers have been experiencing an emotional tug-of-war between wanting consistency — which makes people feel safe — and wanting variety — which provides a welcome diversion. The modest 3-point dip in “novelty” reflects the most recent consumer urge for comfort, familiarity, and reassurance.

- Consumers maintain mild confidence in their ability to regain control. Consumers’ sense of control took the biggest hit when the pandemic initially reached the US in March; since then, “efficacy” scores have remained consistent.

What This Means For Brands

As certain businesses begin to reopen in pockets of the US, brands must continue monitoring key consumer emotions to understand how quickly consumer demand will rise and how to fine-tune the right emotional tone that draws customers in. News about the pandemic and potential solutions continues to stream in; as a corollary, consumer energy levels will grow in fits and starts. Further, the pandemic affects consumers in different ways and with different levels of intensity. While aggregate consumer energy provides the baseline, brands should track consumer energy levels among their priority segments or within priority regions to tailor outreach. For example, the latest data suggests that:

- Urban consumers are less charged and ready to plug into new brands than their non-urban counterparts. In urban areas where the pandemic has had the most drastic impact, consumers are still enervated; in rural areas where the pandemic has been relatively less disruptive, consumers are energized about the idea of resuming activity. According to the latest data, the consumer energy score for urban US online adults is 39; among suburban consumers, consumer energy jumps to 43, and among rural consumers, consumer energy reaches 45.

- Urban consumers are stimulated by brands that offer novelty; non-urban consumers are motivated by brands that validate community identity. Although their overall consumer energy is low, urban consumers have the greatest appetite for novelty — the current emotional state indicates that these consumers are most in the mood for discovery and entertainment. Rural consumers’ high energy levels are fueled by a surge along the “identity” dimension, indicating that these customers increasingly feel a sense of community and are tuned into brands that reinforce this emotion.

Questions, comments, or ideas? I look forward to sharing more data detail and discussing via inquiry.