Digital Banking Innovation In Turkey

In our research on eBusiness and channel strategy, we often come across clusters of innovation where innovation by one company in a sector causes its competitors not only to match it, but to try to leapfrog it — resulting in a rapid cycles of innovation. Among the examples of these clusters are insurance companies in the US (Progressive, Geico and a growing number of others) and banks in Spain (Bankinter, La Caixa, BBVA and Banco Sabadell).

Another of those clusters is the retail banking market in Turkey. Last week I was in Istanbul and was able to see some of the innovations in person and meet a number of heads of eBusiness at Turkey's big banks. Turkey's banks have been quick to adopt digital technologies and achieved some world firsts for the banking industry. Here are a few examples you might like:

Ziraat Bank has deployed a network of unstaffed video kiosks (see picture, right), which it calls video teller machines, that use video-conferencing to connect customers with agents in the bank’s contact centre. Customers can use the kiosks to deposit and withdraw money, buy and sell foreign exchange, pay bills, transfer money and buy bonds. The kiosks let the bank expand its network much more quickly than building conventional branches would do.

Ziraat Bank has deployed a network of unstaffed video kiosks (see picture, right), which it calls video teller machines, that use video-conferencing to connect customers with agents in the bank’s contact centre. Customers can use the kiosks to deposit and withdraw money, buy and sell foreign exchange, pay bills, transfer money and buy bonds. The kiosks let the bank expand its network much more quickly than building conventional branches would do.

- DenizBank became the first bank in the world to lets it customers access their deposit and credit card accounts through Facebook, when it launched its Facebook 'branch' or app in January this year. Customers can access their accounts, see their account status and purchase history, see an overview of assets and liabilities, send money to friends on Facebook, and apply for credit cards and loans. There's even an integrated financial and Facebook calendar. To use the service, customers have to log in to internet banking to activate Facebook banking use; they can then log in to their account on Facebook with their Facebook user name and password, and an SMS password that is sent to their mobile phone when they log in. The application has helped the bank to gain some 200,000 fans on Facebook. There's a video and a press release with more details.

- DenizBank already lets prospects apply for credit through SMS, and has recently expanded that service so that people can apply for credit through its @DenizKredi account on Twitter. To apply, people send their ID number and mobile phone number with a direct message to @DenizKredi, and then receive an SMS in response to their credit application. There's a press release with more details.

İşbank has developed an iPad app, pleasingly called İşPad, that offers a wide range of functionality accessed through a spin wheel (pictured right). The app offers a particularly wide range of functionality, including access to a wide range of accounts, payments and wire transfers, stock prices and investing news, portfolio wizards and risk calculators, and retirement planning tools. You can even buy event tickets and novels to read on the beach. It has the kind of design that just makes you want to play with the app.

İşbank has developed an iPad app, pleasingly called İşPad, that offers a wide range of functionality accessed through a spin wheel (pictured right). The app offers a particularly wide range of functionality, including access to a wide range of accounts, payments and wire transfers, stock prices and investing news, portfolio wizards and risk calculators, and retirement planning tools. You can even buy event tickets and novels to read on the beach. It has the kind of design that just makes you want to play with the app.

- In a separate iniative, İşbank is using biometric authentication on 2,400 ATMs and in 1,000 branches across Turkey, which means customers can withdraw cash using their fingerprint image without the need for a card.

- Yapi Kredi Bank, Garanti Bank, Akbank and most recently DenizBank have partnered with mobile operator Turkcell to offer mobile contactless payments, based on the Near Field Communication standard. The operator's Cep-T Cüzdan mobile wallet service lets users make payments with an NFC-equipped phone.

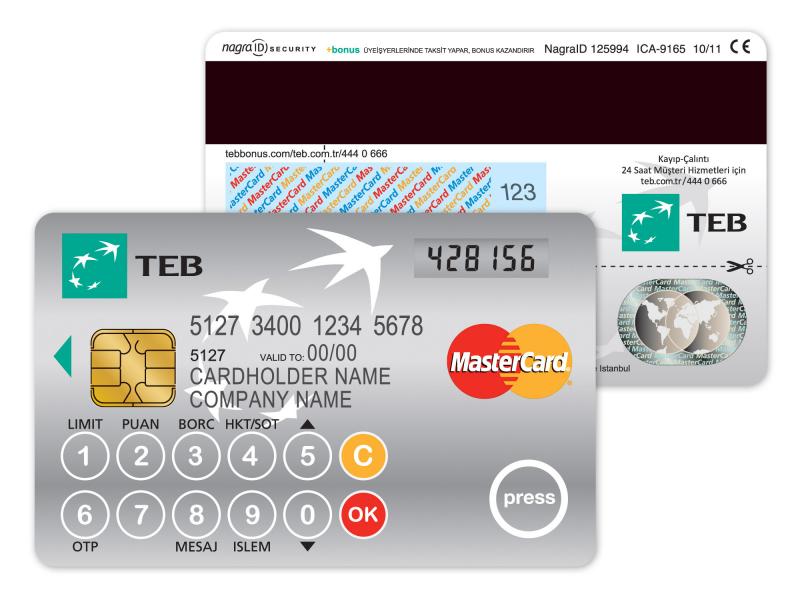

Turk Ekonomi Bankasi (TEB) became the first bank in Europe to give customers debit cards with built-in authentication technology, complete with keypad and screen (pictured right). The bank ran a pilot for a new type of debit card with a keypad and a small screen that can generate a one-time password. Customers simply enter their PIN on the card’s keypad and the card then displays a one-time password, to either access online banking or validate an online purchase. Cardholders can even view their account information such as credit limit, balance, recent transactions, payment dates and loyalty program reward points. Here's a video and press release with more details.

Turk Ekonomi Bankasi (TEB) became the first bank in Europe to give customers debit cards with built-in authentication technology, complete with keypad and screen (pictured right). The bank ran a pilot for a new type of debit card with a keypad and a small screen that can generate a one-time password. Customers simply enter their PIN on the card’s keypad and the card then displays a one-time password, to either access online banking or validate an online purchase. Cardholders can even view their account information such as credit limit, balance, recent transactions, payment dates and loyalty program reward points. Here's a video and press release with more details.

Many of these innovations exemplify the principles of Simplicity, Ubiquity, Personalization, Empowerment and Reassurance that we wrote about in our Next Generation Digital Financial Services research.

Thank you to all the people who shared their thoughts on the future of retail banking and made me feel so welcome in Istanbul. 🙂

Benjamin