The Data Digest: Health Insurers Must Ensure Satisfaction

The US health insurance industry is in the midst of a tectonic shift. Since federal legislation mandated health coverage for all US citizens, health insurers have been pivoting away from pure B2B models to reinvent themselves as B2C services – and they’ve been responding to the demands of a new target group: consumers who purchase their own health insurance.

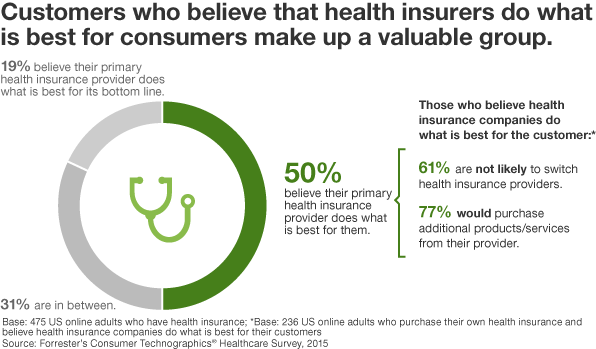

Earlier this year, we published a blog post detailing the channels customers use when purchasing health insurance. But mapping customers’ physical interactions with a company is only part of the story – understanding their emotional evolution is just as important. According to Forrester’s Consumer Technographics® data, a mere 50% of consumers who purchase their own health insurance feel that the brand puts them first; others believe health insurers do what’s best for their own bottom line at the expense of customers. The former are not only emotionally satisfied, they are also loyal to their current health insurer and willing to spend on additional products and services:

Furthermore, consumers who experience a positive emotional relationship with their health insurance provider are more likely to engage with digital tools on their insurer’s website or mobile app, are more confident in their own healthcare decisions, and feel empowered to manage and improve their health.

Therefore, the health insurer’s challenge is not only to reach consumers across fragmented online and offline channels but also to resonate with consumers emotionally. This means that adopting a customer-centric mindset is no longer a nice-to-have for health insurers; it is a must-have. My recent report explores the factors along the health insurance purchase journey that drive emotional value. The research reveals that boosting satisfaction doesn’t necessarily involve cutting prices and adding benefits as much as setting and meeting customer expectations. Health insurers that give individuals the information and connection they need successfully manage emotions and pull the key levers of satisfaction that make customers feel valued.