The Data Digest: The Multifaceted Journey To Purchasing Health Insurance

If you’ve been following our blog, you’ll know that the Data Insights team here at Forrester has been tracking the evolution of US healthcare reform over the past three years and its implications in terms of consumer behavior, attitudes, and expectations. Our study began in July 2012, when we advised health insurance companies how to prepare for the flood of new customers entering the market. Two years later, my colleague Gina Fleming extended this analysis into Forrester’s Healthcare Segmentation, which provides a refined understanding of key customer profiles. Now, with our 2015 Consumer Technographics® Healthcare Survey just back from field, we can complement our understanding of the US consumer health insurance market with another layer of insight: the member’s journey to purchasing health insurance:

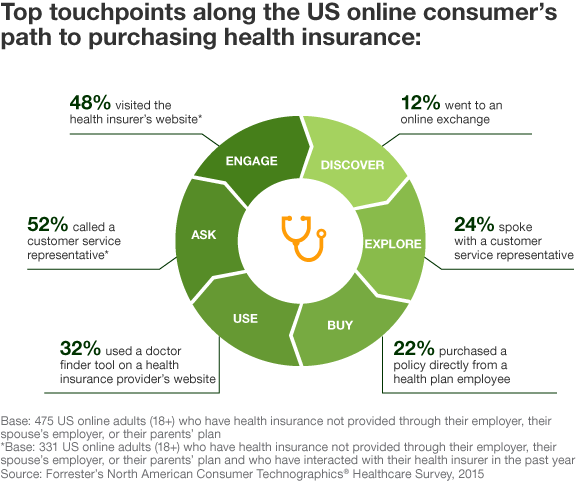

According to this data, individuals who purchase their own insurance (i.e., those who don’t have insurance provided through their employer, their spouse’s employer, or their parents’ plan) bridge the online and offline world as they discover, explore, buy, and engage with health insurance brands. Specifically, while their decision-making journey often originates on a health exchange website, it shifts to phone-based or face-to-face interaction. Ultimately, the health insurance user experience encompasses both channels.

Today, as our world is buzzing with a profusion of devices, fragmenting marketing channels, and abundant information, consumer paths to purchase are increasingly complex – and health insurance coverage is no exception. According to my colleague Peter Mueller, 2015 will be the year that healthcare responds to consumer expectations of multichannel experiences and overhauls its digital experience. In his recent report, he says that “insurers and providers [will] build consumer-centric journeys that leverage best practices from retail industries. . . . Whether it’s online enrollment, healthcare personal financial tools, or improved engagement and care coordination, retail customer journeys will begin moving beyond experimentation to digital delivery products and services for mass adoption.”

How will such an overhaul influence consumers’ selection, perception, and loyalty in terms of health insurance providers? Stay tuned over the coming year to find out.