The Data Digest: Variation In Tax Preparation Behaviors Among US Online Adults

Do industry innovations change the consumer or do consumer demands change the industry? That's the question when looking at how US online adults prepare their annual income tax returns. When the IRS ceased its mailings of paper forms before the 2011 tax season, approximately 15 million more consumers began filing their taxes online. But would this have happened anyway? We could argue that as media consumption, financial management, shopping transactions, and other traditional behaviors moved online, it’s only natural that consumers’ tax filing practices would have too.

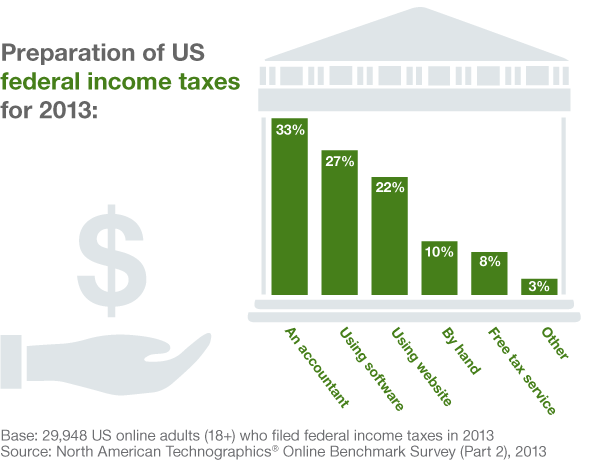

At a subliminal level, the decision about how to file taxes speaks to one's comfort level with new technology, sensitivity to data privacy, desire for convenience, and embrace of old habits. Our Consumer Technographics® data shows a variation in how US online adults prepare their taxes: While 33% defer to professionals, 27% file their own taxes by downloading computer software, and 22% do so through a website. One in 10 of these consumers still files taxes by hand using paper forms.

Although consumers leverage a variety of channels to prepare their annual taxes, there is a common denominator across all channels: the desire for an accurate, convenient, and user-friendly method of engagement. In fact, as my colleague Rick Parrish notes, when it comes to expecting a quality customer experience, people hold the government to the same standards as leading companies. And in this case, those consumer expectations are driving change among institutions: In his recent report, Parrish suggests that, "President Obama's fiscal-year 2015 budget proposal features customer experience like never before, setting up some federal agencies for windfalls that will help them improve experiences for hundreds of millions of US citizens." The administration’s willingness to enhance its consumer interaction reinforces the idea that adopting a “consumer-first mindset” is valuable across industries and institutions.