Data Center Networking: The Awkward Teenage Years

Forrester has just completed a comprehensive analysis of data center networking solutions from Alcatel-Lucent, Arista Networks, Avaya, Brocade Communication Systems, Cisco Systems, Extreme Networks, Hewlett-Packard, and Juniper Networks. Instead of comparing just the vendors’ features and functions and positioning them accordingly, we took an outside-in approach. We stepped into the customer’s shoes and crafted 85 questions based on the needs of a composite company. This composite is representative of the kind of companies we talk to every day. In fact, this customer perspective came from Forrester’s customer inquiry calls, network assessments, and large-scale business surveys.

Forrester created an RFP based on an infrastructure and operations (I&O) organization that’s: 1) facing decreasing IT budget; 2) wanting to evolve their operations team from technology silos into a service organization; and 3) looking to transform their data centers from a consolidated infrastructure to a private cloud. They need a system that reconfigures elements on the fly and monitors the output to ensure that the newly created services adhere to business policies and rules — a concept we call virtual network infrastructure (VNI). Forrester defined VNI in 2011 as the ability to accomplish five tasks:

- Leverage virtualized and physical infrastructure.

- Act as a vertically integrated Layer 2 to Layer 7 module within the infrastructure.

- Create a fabric of horizontally interwoven networking components.

- Automate and orchestrate the infrastructure to deliver the right services for each user (AKA SDN/programmability).

- Allow management and control by lines of business.

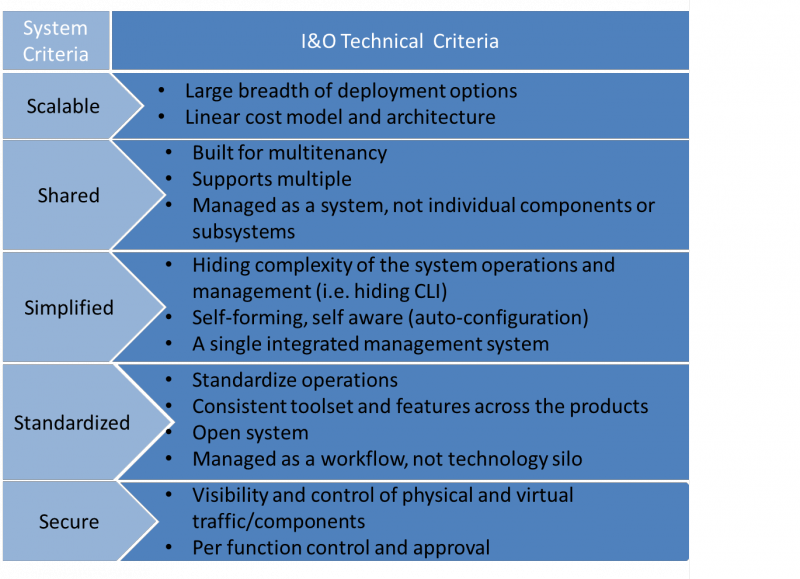

This composite company requires the system to: 1) scale while building out their three data centers; 2) reduce the amount of manual setup and operations; 3) help to standardize processes and procedures; 4) share the infrastructure for workloads; and 5) increase the trust levels. We’ve outlined these requirements separately and refer them to as the five S’s.

After combing through customer stories, technical documents, and vendor responses, Forrester found that, even though the proposed solutions offer tremendous value, today’s data center networking solutions are immature. They’ve just hit their “teen years” and exhibit teenager characteristics:

- Continuously re-identify themselves. At one time, data center networking characteristics were one-dimensional, focused on flattening the network. Now the conversation has expanded to include the integration of virtualized and physical infrastructure while creating a fabric of horizontally interwoven networking components. However, customers will be hard-pressed to find a consistent definition from each vendor that hasn’t evolved over the past two years. And guess what? They’re likely to change it several more times in the next three years.

- Require adult supervision. No matter how many software-defined networking (SDN) slides are shown, network automation is limited to reacting to VM movement. The systems monitor one boundary condition when the system should be monitoring thousands, if not hundreds of thousands, of instances (virtual and physical ports/links/switches, applications, policies, etc.). Networking teams should expect continuous babysitting. They’ll be manually configuring the devices and adjusting knobs to figure out the bandwidth allocation, QoS settings, buffering settings, etc.

- Are moody. Overlay Transport Virtualization (OTV), Virtual Ethernet Port Aggregator (VEPA), Virtual eXtensible Local Area Network (VXLAN), and others are new technologies that have little mileage and can be unpredictable or fail to even work in certain environments. Some customers said they rolled back some of their deployments because the technology was just too temperamental.

- Feel isolated. Many of the data center networking components from a single solution are tightly interwoven with each other; however, few venodors have provided interfaces that enable the network subsystem to share stateful information with another subsystem. The cliques are alive and well within the data center.

- Act self-absorbed. Networks will encompass both virtual and physical aspects. This means policies, control, and network services have to go past the last physical edge port. Virtual network functions belong to the network domain, except most solutions don’t offer visibility, control, or management of the virtual network. This overly inward focus will likely thwart I&O from realizing true benefits of a next-gen data center.

Thus, no company took a leadership position in our data center networking Forrester Wave™. However, Cisco and HP lead the Strong Performers category. Each of the Strong Performers provided capabilities in two or more of the five S’s. Cisco and HP separated themselves from the pack with a complete road map and vision toward delivering VNI functionality. For example, not only does Cisco offer the largest breadth of hardware products and features, but its offerings also allow I&O professionals to start thinking about enabling hybrid clouds. HP takes a different approach and focuses on driving simplicity into operations, synchronizing virtual and physical networks, and integrating networking into the orchestration layer. Only because of a late start, Alcatel-Lucent, Extreme Networks, and Juniper are rapidly building out their data center portfolios. Each vendor has a smaller set of options because they entered the game much later than Cisco. The Contenders — Arista, Avaya, and Brocade — all have strong products for aspects of the data center but didn’t address the full requirements of the Forrester Wave’s composite organization.

This doesn’t mean that one of the vendors won’t be best suited for your area. The Forrester Wave is a living document that can be altered to fit your goals. By adjusting weights of the criteria, I&O professionals can see a different set of results that will rank vendors according to their own business technology strategy.